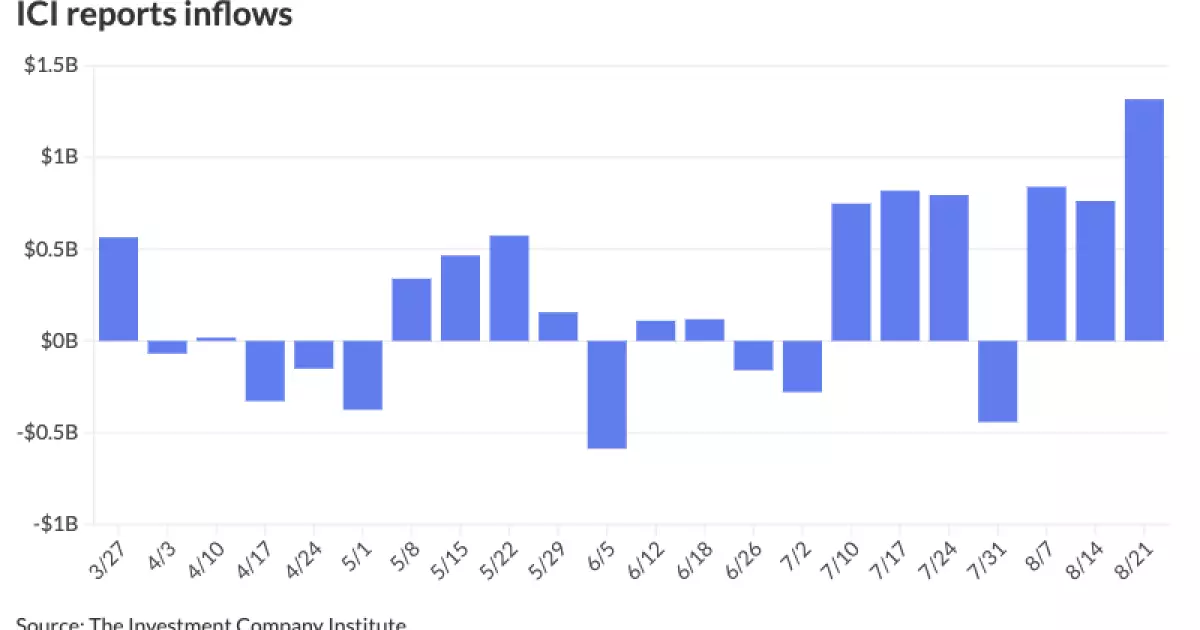

The municipal bond market remained relatively steady on Wednesday as some of the week’s largest deals were priced. The Investment Company Institute also reported over $1 billion in inflows into municipal bond mutual funds. This stability was reflected in U.S. Treasuries, which saw minimal changes across the yield curve. Additionally, equities closed down slightly at the end of the day.

The muni-to-Treasury yield ratios on Wednesday were as follows: two-year at 63%, three-year at 65%, five-year at 66%, 10-year at 70%, and 30-year at 87%, according to Refinitiv Municipal Market Data. ICE Data Services reported slightly higher ratios in some categories, with the two-year at 64%, three-year at 65%, five-year at 66%, 10-year at 71%, and 30-year at 88%. These ratios provide insights into the relative attractiveness of municipal bonds compared to Treasuries.

While muni yields were relatively unchanged on Wednesday, they have seen a downward trend since the beginning of the summer. Tom Kozlik, managing director at HilltopSecurities, noted that while yields are currently at attractive levels, they are not as appealing as they were earlier in the year. Despite this, they remain historically attractive.

The Investment Company Institute reported significant inflows into municipal bond mutual funds, with over $1.3 billion coming in for the week ending Aug. 21. This marks a substantial increase from the previous week. While these inflows indicate continued investor interest in municipal bonds, they have not yet reached the levels seen earlier in 2021 when inflows surpassed $100 billion for the year.

Municipal bonds are currently seen as a valuable investment compared to corporate bonds and Treasuries. Cooper Howard, a fixed-income strategist at Charles Schwab, pointed out that the tax rate required for munis and corporates to yield the same after-tax return is relatively low. This, combined with stable credit conditions, makes munis an attractive option for investors in higher tax brackets.

The potential for a Federal Reserve rate cut has added uncertainty to the market. While the yield curve is expected to steepen as a result of rate cuts, the exact magnitude of the cut remains unclear. Federal Reserve Chairman Jerome Powell’s recent speech at Jackson Hole suggested that rate cuts are imminent, with the possibility of larger cuts in the future. This uncertainty may lead to increased volatility in the market.

In the primary market, several large deals were priced, including transactions for Chicago O’Hare International Airport, San Antonio, Texas, the Utah Transit Authority, the Texas Veterans Land Board, and the University of Kentucky. These deals highlight the ongoing activity and demand in the municipal bond market.

Various sources reported minimal changes in municipal bond yields, with some fluctuations observed in specific maturity segments. While overall yield levels remained relatively stable, the potential for future rate cuts by the Federal Reserve may impact the shape of the yield curve in the coming months.

Overall, the municipal bond market continues to exhibit stability and attractiveness to investors. With ongoing inflows into mutual funds and favorable yield levels compared to other fixed-income assets, munis present a compelling opportunity for investors seeking tax-efficient returns. However, uncertainties surrounding Fed rate cuts and economic indicators may introduce volatility and shifting market dynamics in the near future. It is crucial for investors to stay informed and monitor these developments to make informed decisions in the municipal bond market.