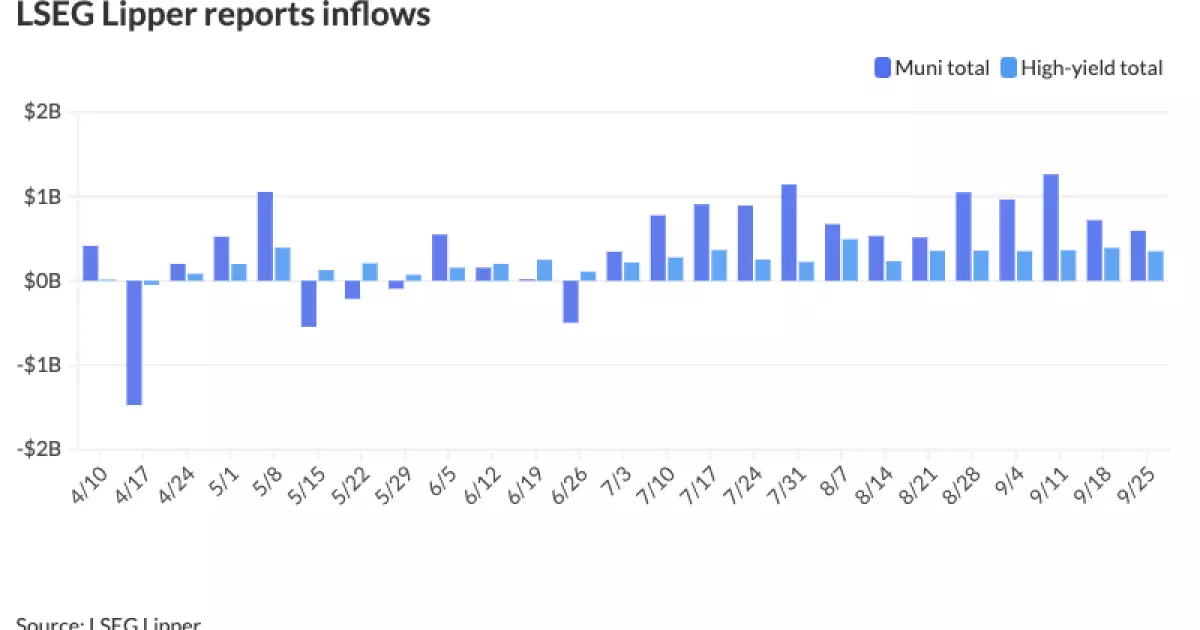

This week, municipal bonds demonstrated notable stability amid significant market events. As the last significant deals of the week were priced, municipal bond mutual funds reported inflows for the thirteenth consecutive week, with high-yield offerings particularly driving this trend. During this timeframe, municipal bonds navigated a separate path from a somewhat mixed U.S. Treasury market while equities underwent a rally, highlighting distinct market dynamics.

The data reveals a consistent pattern across various maturities in the municipal-to-Treasury ratio. For instance, the two-year ratio stood at 64%, with similar rates for the three-year, and slightly higher numbers for the longer tenors, indicating a persistent yield spread that could influence investor decisions. In contrast, experts like Kim Olsan from NewSquare Capital remarked on the absence of metrics that typically elevate municipal bond rates, suggesting a market that remains cautious despite elevated issuance volumes.

One of the significant aspects of the current environment is the decrease in daily bids wanted, down 15% from the yearly average. Coupled with an anticipated issuance topping $40 billion for September, this presents a compelling narrative of shifting market behavior. The Bond Buyer notes that liquidity is on the rise, with a visible supply of $13.98 billion, which could play into competitive pricing strategies.

The inflows recorded this quarter, amounting to an impressive $8.8 billion despite a fleeting period of nominal outflows, underline a robust appetite for municipal bonds among investors. This is further evidenced by the LSEG Lipper data, which indicates strong continued interest in high-yield bonds with $592.1 million in new investments over the week ending Wednesday, demonstrating a sustained preference despite fluctuations. The influx into municipal high-yield bonds, totaling $12 billion, exemplifies a return to normalized issuance levels that reflect improvements compared to lower volumes of previous years.

High-yield municipal bonds continue to gain traction, marking a significant recovery from earlier months characterized by low issuance. The year-to-date total for high-yield bonds is reported at roughly $20 billion, comparable now to the five-year average for the same period. As noted by J.P. Morgan strategists, the ongoing demand for yield-optimized offerings persists, exceeding supply capabilities. This trend illustrates a fundamental shift where interest in fixed-income investments, particularly those with high tax-equivalent yields, is evidently increasing.

Fund managers report that rising cash reserves on the sidelines have begun to enter play, encouraging more allocations towards municipal securities as fixed-income products reflect stronger overall importance in strategic portfolios. Looking ahead, the anticipated outsized supply in October, primarily due to looming election activities, could introduce upward pressure on yields but is expected to remain contained in the short run.

Investors in high tax brackets find noteworthy value in municipal bonds, with intermediate AA-rated offerings trading around 2.75%. The corresponding taxable equivalent yields (TEYs) of these instruments highlight their appeal, reaching approximately 4.50%. Alongside this, long-dated bonds with 5% coupons trading around 3.60% provide even more lucrative TEYs of up to 6.00%, showcasing the competitive edge these bond structures hold against corporate alternatives.

A specific examplar within the market, the Salt River Project Agricultural Improvement and Power District in Arizona, recently priced their 5s of 2034 at an attractive 2.72%, alongside a longer maturity of 5s of 2049 at 3.64%. Additionally, the issuance of larger bonds with 4% coupon structures beyond 15 years demonstrates strong backing from both individual and institutional investors, as participants seek appreciation from potential future rate declines.

The primary market has witnessed considerable transactions, such as BofA Securities pricing the Texas Water Development Board’s state water implementation bonds, reflecting competitive pricing across the curve. Montgomery County’s recent offerings highlighted that even risk-averse investors are being drawn in, with a diverse range of maturities attracting strategic bidders.

The current attractiveness of municipal bonds against a backdrop of an evolving Treasury yield curve, where modest fluctuations can be observed, indicates that savvy investors may want to consider re-evaluating their portfolio strategies. The AAA-rated scales remain relatively unchanged, marking stability amidst a typically turbulent market environment.

While the municipal bond market displays resilience, investors must navigate this landscape with a discerning eye, balancing the promise of yields against potential fluctuations. The patterns of strong inflows and evolving issuance dynamics create a fertile ground for informed investment decisions, making it a crucial period for both existing and prospective municipal bond investors to engage thoughtfully with market opportunities.