Over the past few trading sessions, municipal bonds have faced marginal weakening, marking their fourth consecutive day in this trend. This follows the notable declines in U.S. Treasury yields, all while equity markets show signs of life with gains. On Wednesday, municipal bond yields rose up to three basis points, whereas U.S. Treasury (UST) yields increased by approximately four to five basis points. This uptick pushed the two-year UST yield above 4%, a level not observed since late August. The yield spread, especially pertinent for evaluating municipal bonds relative to Treasuries, has reached significant levels: the two-year ratio stood at 61%, while longer durations such as the 30-year showed an 84% ratio.

The recent data provided by Refinitiv Municipal Market Data and ICE Data Services indicates a robust active market for municipal bonds despite the recent yield fluctuations. The increasing ratios signify growing investor inclination towards tax-exempt municipal bonds as attractive alternatives amidst varying rates in the Treasury market.

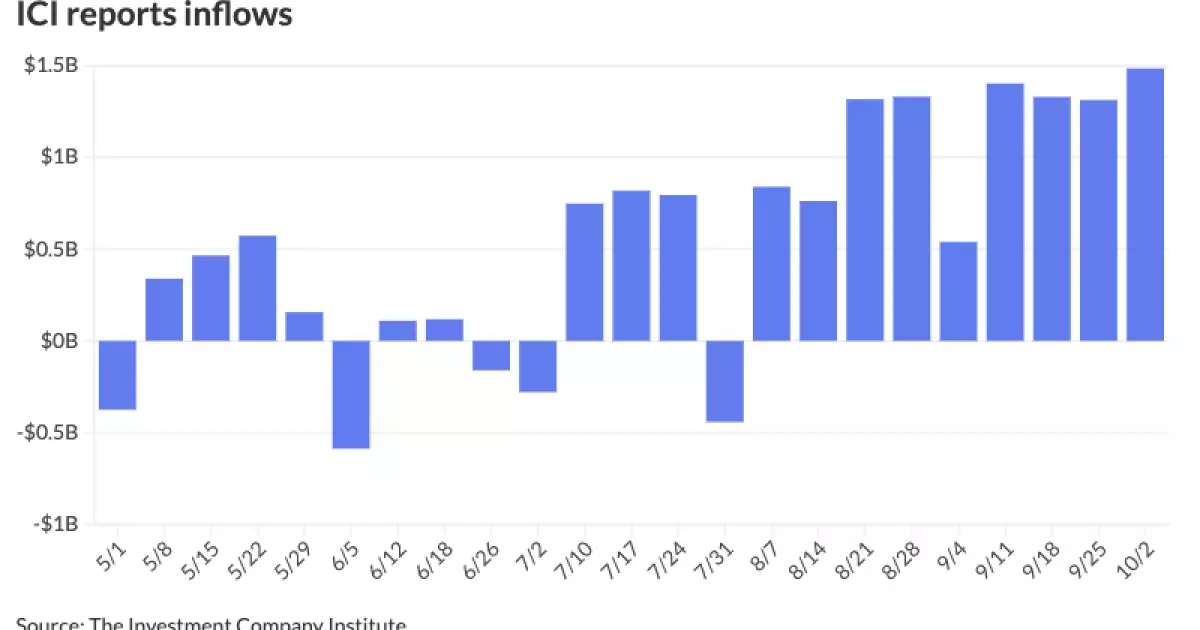

The Investment Company Institute highlighted a noteworthy trend in capital flowing into municipal bond mutual funds, reporting inflows of approximately $1.484 billion for the week ending October 2. This marks a consistent influx over nine weeks, with four weeks exceeding the $1 billion threshold. Exchange-traded funds have also attracted substantial investments, totaling $810 million, indicating strong market confidence fuelled by favorable conditions.

Analysts such as Jeff Lipton, a market strategist, underscore that the technical backdrop plays a crucial role as municipalities navigate into the fourth quarter. Factors like dwindling stimulus, a proactive refinancing landscape for Build America Bonds, and diminished concerns regarding monetary policy shifts pave the way for an optimistic outlook. This scenario has led issuers to accelerate their offerings, particularly in anticipation of the upcoming presidential elections, resulting in a pronounced increase in tax-exempt supply.

The current environment is characterized by brisk municipal bond issuance, with supply often exceeding $10 billion on a weekly basis barring shorter weeks due to holidays or Federal Open Market Committee meetings. Although analysts, including Daryl Clements, predict this ample supply will be well-received, there is a suggestion that relative valuations may begin to appear tighter. Selective buying could emerge as investors reassess the attractiveness of various offerings against their thresholds for yield and risk.

Looking ahead to the election, it’s anticipated that supply may diminish temporarily before ramping back up as the year draws to a close. The potential for stable economic data and a more gradual approach to rate reductions by the Federal Reserve could support municipal bond valuations; however, fluctuations in investor sentiment and market movements remain pivotal in influencing bond performance.

Throughout recent trading sessions, as economic indicators lean toward supportive structures for municipal bonds, the market has experienced fluctuations in both demand and supply. As noted, robust demand continues, driven by investors facing October reinvestment requirements and attractive yield ratios. This favorable setup has prompted many to revisit their allocations to municipal bonds, effectively reversing some previous underperformance.

With ongoing ample supply and manageable reinvestment necessities as the year concludes, opportunities may arise for opportunistic buying in the upcoming weeks. As institutional investors focus on relative value, retail investors appear increasingly drawn to the calculations of taxable equivalent yields, bolstering the appeal of municipals.

In recent activity, significant offerings came to the forefront, including a $935 million general obligation bond issuance for Connecticut, which highlighted adjustments from prior pricing rounds. The structures included various maturities, each reflecting modest cuts from earlier retail prices, showcasing how market dynamics affect institutional purchasing strategies.

Other notable issuances include the New York State Housing Finance Agency’s revenue bonds and the Arizona Board of Regents’ refunding bonds. Each issuance provided vital insights into how market participants are navigating the complexities of yield curves and market demands, with entities keenly aware of adjusting their offerings based on prevailing economic conditions.

The municipal bond market is currently operating within a framework shaped by external economic pressures and internal strategic maneuvers by issuers. With the balance of supply and demand appearing relatively stable, investors must remain vigilant to the ongoing shifts in U.S. Treasuries and the broader economic landscape. As we approach the year’s end, a careful evaluation of emerging opportunities in municipal bond investments will be integral for both institutional and retail investors seeking to optimize their portfolios in an evolving financial environment.