In the recent financial landscape, Build America Bonds (BABs) have experienced a notable slowdown in redemptions, largely due to volatile market conditions and rising interest rates. This article explores the implications of these challenges on the BAB issuance and refunding processes, while also examining the future outlook for these financial instruments amidst changing economic conditions.

Data from J.P. Morgan highlights that approximately $14.9 billion of BABs have already been called back in 2024. An additional $938.3 million is currently set to follow suit, indicating that despite an overall decline in redemption activity, there remains a select group of issuers interested in redeeming their bonds before the year concludes. To provide context, this trend corresponds with a broader narrative of financial prudence amongst issuers, who are showing increased caution in their refunding strategies.

According to financial analysts, the rationale for calling back these bonds is grounded in cost-effectiveness. Nick Venditti, head of Municipal Fixed Income at Allspring, emphasizes that refunding BABs only makes economic sense when interest rates are significantly lower than current levels. The current state of the market, with the 10-year U.S. Treasury yield at 4.27%, makes it challenging for issuers to realize the same financial benefits they might have obtained earlier in the year.

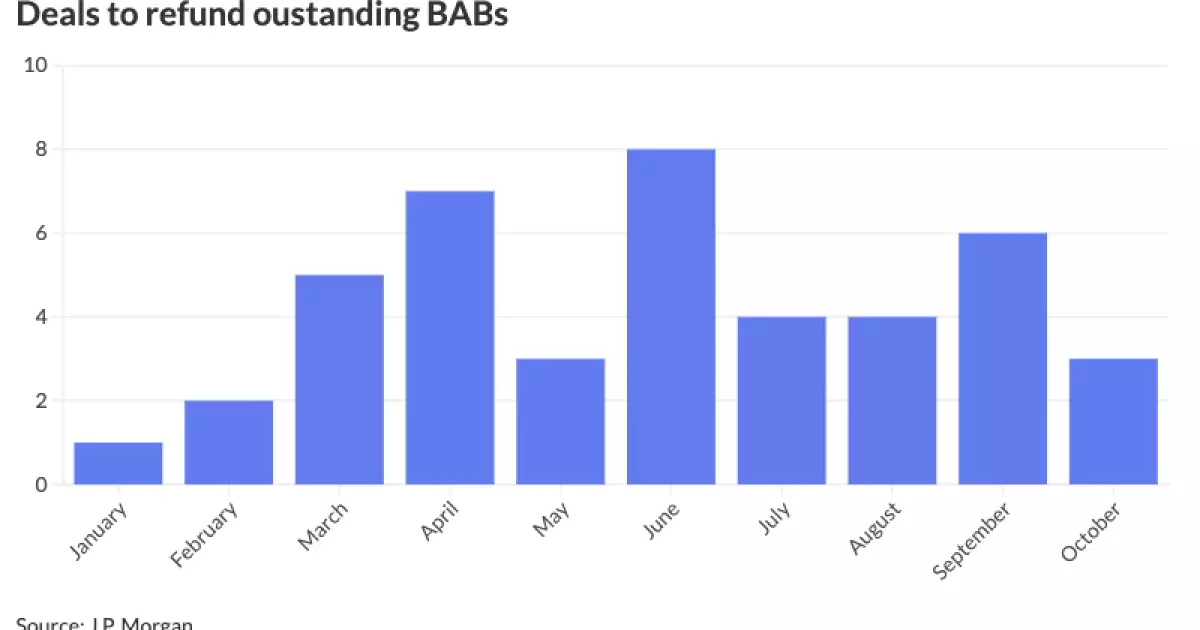

The issuance of BABs has reflected a rollercoaster trajectory. Refundings initially lagged in the first quarter of the year, only to surge dramatically in the second quarter of 2024. This was followed by a noticeable slowdown in the third quarter, showcasing the unpredictable nature of market sentiment and interest rate fluctuations. The peak of activity was observed in June, with eight refunding transactions, while other months yielded significantly fewer deals.

The most considerable BAB refunding activity of the year was reported from the Los Angeles Unified School District, which issued $2.9 billion in general obligation refunding bonds. This signifies a strategic move by larger issuers to capitalize on favorable circumstances when they arise, despite the challenging environment that has characterized the municipal bond market recently.

James Pruskowski, chief investment officer at 16Rock Asset Management, notes a distinct shift in issuer behavior. Following an aggressive push to refinance in the second quarter, market uncertainties stemming from rising interest rates have led to diminished interest in new BABs issuance. Furthermore, the third quarter of 2024 exhibited a marked decline in refinancing urgency, reflecting a stabilization of issuer priorities amid shifting market conditions.

As observed by Barclays strategist Mikhail Foux, rising municipal-to-U.S. Treasury ratios further exacerbate the situation, reducing the likelihood of future BAB refundings via extraordinary redemption provisions. High ratios signal that tax-exempt municipals have not performed as well in the market, leading many issuers to reconsider their lending strategies.

The influence of market volatility was poignantly illustrated by the Ohio Water Development Authority’s decision to withdraw a $102.02 million bond offering intended to refinance existing BABs. Executive director Mike Fraizer explained that the potential for minimal net present value savings led to the postponement of the transaction. Renewed efforts to refund the existing BABs will occur at a more opportune time, demonstrating a strategic approach underpinned by market conditions.

Despite a climate of caution, some issuers continue to push forward. Ballard Spahr recently engaged in a BABs refunding deal for $177 million for Baltimore County, indicating that select transactions still occur even amid hesitance in the market. Teri Guarnaccia, a partner at the firm, noted the lack of investor pushback during this deal, suggesting a degree of confidence returning to certain segments of the BABs market.

The outlook for BABs remains complex, primarily due to the uncertain macroeconomic environment. Investors are exhibiting reluctance to engage with these bonds, largely because of their call risk, as highlighted by Venditti. While some institutional investors might lean towards other products like taxable munis, BABs may struggle to regain their appeal unless legislative guarantees can mitigate call risks.

Ultimately, the evolving landscape of BABs reflects broader trends within the financial markets. As issuers adapt their strategies and reconsider their cost structures, the future of this asset class will depend heavily on both legislative developments and macroeconomic stability. The return to confidence among issuers and investors will likely hinge on whether conditions align favorably to incentivize participation in Build America Bonds in the years to come.