As the U.S. prepares for pivotal elections and an impending decision from the Federal Open Market Committee (FOMC) regarding interest rates, the municipal bond market is experiencing a wave of adjustments and heightened volatility. Market participants are strategizing their positions as they brace for the implications of these two significant events. A closer examination reveals the complexities at play within the bond market and broader economic considerations driving investor sentiment.

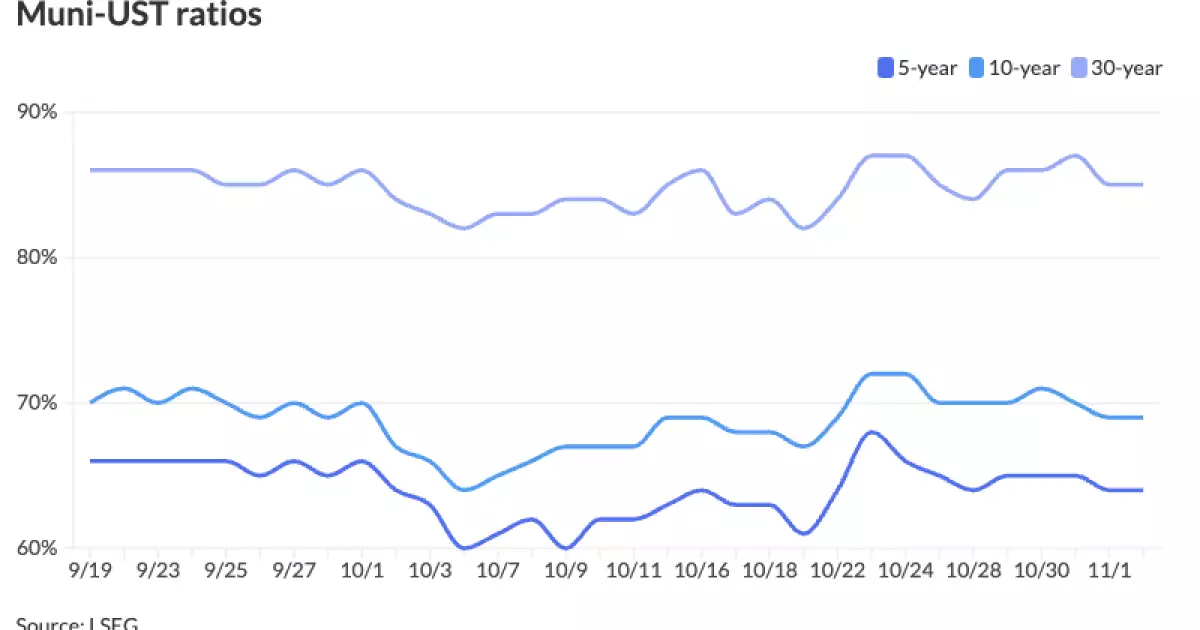

Recent trading sessions have shown a calming buoyancy in municipal bonds, attributable to a drop in U.S. Treasury yields. Specifically, yields for longer-term securities saw marked improvement, suggesting that investors are leaning towards safe-haven assets given the uncertainties brewing on the political horizon. According to municipal market data, ratios have indicated moderate spread compression, with figures for various maturities hovering around typical historical levels.

For instance, the two-year municipal yield matched the U.S. Treasury yield at 63%, while the longer maturities have shown varying degrees of stabilization. This readiness to absorb volatility is pivotal as the market holds its breath before the electoral outcome and potential shifts in monetary policy.

Daryl Clements, a municipal portfolio manager, foresees significant repercussions from the election results that could lead to varied market reactions. The conventional wisdom suggests that a Republican victory could trigger a surge in yields and inflation expectations, whereas a Democratic sweep may lead to increased tax burdens countering projected spending initiatives. These conjectures underline the gridlocked nature of governmental policymaking, where a divided Congress might represent the least disruptive scenario for market stability.

While market analysts warn of potential knee-jerk reactions tied to electoral developments, the need for a nuanced understanding of the underlying economic signals cannot be overstated. As Clements noted, regardless of the election outcome, the overarching trend points towards a gradual decrease in yields over time, especially if liquidity dwindles amid seasonal pressures.

Further contributing to the market’s trepidation is the upcoming FOMC meeting, where the central bank will deliberate on its monetary policy courses. With recent economic indicators reflecting a somewhat weaker-than-expected performance—namely a subdued third-quarter GDP and sluggish job growth—the Fed’s decision-making process remains highly data-dependent. Tom Kozlik highlights that the recent economic data may push the Fed to consider alternative trajectories, including the possibility of continued rate cuts or maintaining the current target rate.

These economic signals cast an overarching shadow over municipal bond performance, with new investment strategies being crafted in response to anticipated shifts in monetary policy by the Fed. Amidst this uncertainty, the importance of adapting to changing economic realities becomes vital for both institutional and retail investors.

In response to market conditions, investors are actively reassessing their strategies. Observations indicate a balanced approach to buying and selling municipal bonds, with stronger trade volumes reported. The advocacy for realistic pricing by sellers demonstrates an acknowledgment of the thinning liquidity landscape as year-end approaches. As financial strategists indicate, a notable spike in bid requests suggests a burgeoning appetite for bonds, particularly among investors keen on capitalizing on attractive yields in these turbulent times.

With municipal mutual funds also showing consistent inflows—evidenced by nearly twenty consecutive weeks of positive returns—investor confidence remains resilient amid market upheaval. The confluence of high demand and dwindling supply positions the municipal bond market favorably, suggesting that despite the political uncertainties, the underlying fundamentals may sustain performance.

Looking ahead, market dynamics indicate a promising yet cautious path for municipal bonds. With projected net supply revealing anticipated shortages in new issuances, the technical advantages for bond investors appear increasingly favorable. This narrative is backed by strategic recommendations highlighting the potential for robust performance in the coming months as yield levels stabilize.

In a landscape heavily influenced by ongoing events and economic data, municipal bonds may become an attractive option for investors willing to endure short-term volatility for long-term benefits. The anticipated response to political outcomes and monetary policy decisions will undoubtedly shape the shape of the bond market, but proactive investors who remain informed can navigate these choppy waters with confidence.

As the political and economic fabric of the U.S. shifts, the municipal bond market stands resilient, demonstrating the intricate interplay of investor sentiment, macroeconomic factors, and future opportunities. Emphasizing rigorous analysis and strategic foresight will be crucial as we approach one of the most significant turning points in recent market history.