The recent political landscape has had significant ramifications for financial markets, particularly in the realm of municipal bonds. The results of the election, with former President Donald Trump regaining a foothold and a Republican surge in Congress, propelled a wave of activity across asset classes. This article explores the multifaceted implications of these events on municipal bonds and U.S. Treasuries, examining the broader economic context and future considerations for investors.

Immediate Impact on Yields and Bond Markets

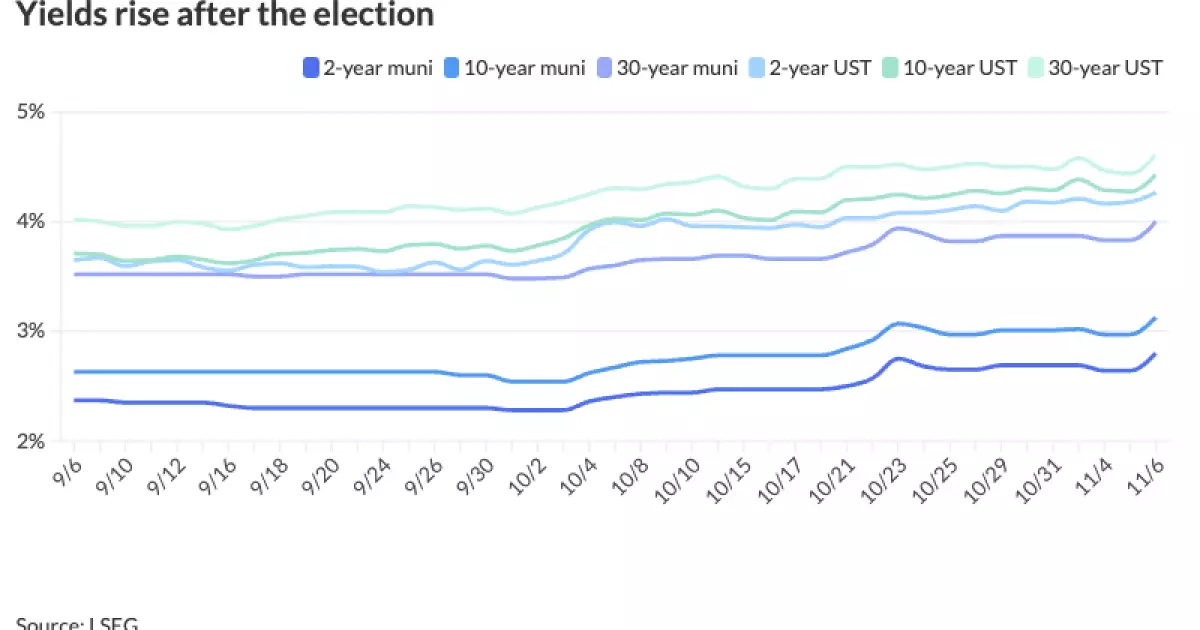

In the wake of election results favoring Trump and the Republicans, municipal bonds experienced a notable sell-off. This trend mirrored the movements in U.S. Treasuries, where yields skyrocketed as part of a wider “risk-on” sentiment in the markets. The spike in yields across municipal triple-A curves ranged from 11 to 17 basis points, demonstrating how quickly investors responded to the altered political landscape. Analysts highlighted that this sell-off was not unexpected; however, the reality of it sparked reactions due to the sheer magnitude of the shift.

Yield curves reflect expectations about the future performance of the economy and the fiscal policy direction. According to market observers, such as Peter Block of Ramirez, while many had anticipated the outcome, the realization carried with it an element of shock. With the fiscal policy likely to shift towards more aggressive spending under the Republican majority, including potential infrastructure investments, there is growing anxiety about the trajectory of bond yields.

As market participants recalibrate their strategies, the ratios of municipal bonds to U.S. Treasuries are noteworthy. For example, the two-year municipal-to-Treasury ratio was recorded at 66%, reflecting a quantitative narrative on how municipal bonds are viewed in relation to their Treasury counterparts. The rising ratios signal an adjustment where municipal securities are now perceived as having comparatively higher risk and yield potential, influenced by the expected economic policies under Trump’s regime.

Economic forecasts indicate that the Republican victory is likely to lead to increased growth expectations. However, higher growth can escalate inflation, which in turn could lead to rising nominal yields on bonds. BMO Capital Markets’ analysts pointed out that the combination of growth surge, inflation expectations, and mounting government deficits would exert upward pressure on yields across the board.

Both the risks associated with inflation and the anticipated response from the Federal Reserve have left many in the market speculating about future rate decisions. The Federal Reserve’s ability to maintain independence amidst shifting fiscal policies is another layer of complexity. The potential for substantial fiscal spending could test the Fed’s conventional approaches, as observed by BMO and other strategists.

Investors are particularly wary of the implications of Trump’s historical approach towards taxation and tariffs, which they believe could alter economic growth dynamics significantly. Some analysts warn that if the anticipated fiscal policies lead to growing deficits without constraints, there may be a tipping point where bond yields could rise sharply, reminiscent of previous market turbulence when 10-year yields flirted with 5%.

Looking ahead, the Federal Reserve is projected to implement a rate cut, which could further influence the municipal bond market. Economists from RBC Global Asset Management suggest that the Fed could continue on this path, taking the effective funds rate down further. However, they also acknowledge that the pace of such cuts would depend heavily on incoming economic data, particularly as Trump’s new administration settles in.

Market strategists are cautiously optimistic yet remain vigilant about the risks that accompany fiscal expansion. The expectation is that if inflation surges due to tax cuts, the Federal Reserve may respond with a more hawkish approach than previously anticipated. The interplay between supply-side policies, which could include tariffs, and the Fed’s monetary stance will be pivotal for bond markets in the coming years.

For investors navigating this complex landscape, understanding the nuances of fiscal policy changes and their implications is critical. The recent sell-off and rising yields present both challenges and opportunities; investors need to determine how to adjust their portfolios to reflect the evolving risk profiles of municipal bonds vis-à-vis U.S. Treasuries. Importantly, the shift in economic sentiment may present investment opportunities, particularly in sectors positioned to benefit from increased infrastructure spending.

As market conditions enter a phase defined by growth projections and inflation concerns, investors are urged to consider the fundamentals driving their decision-making. The potential for fluctuation in yields mid to long-term forecast could necessitate updated strategies to safeguard against adverse conditions, while also capitalizing on recognized investment opportunities presented by the upcoming fiscal activities of the government.

While analysts identified a predictable sell-off in municipal bonds post-election, the factors at play underscore a broader narrative that will likely define bond market trajectories in the near future. Understanding how these changes affect yields, ratios, and broader economic policies will be essential for investment positioning in this dynamic financial climate.