In an atmosphere marked by economic uncertainty surrounding the upcoming elections and fluctuating Federal Reserve interest rates, investors are exhibiting caution, which has manifested in remarkable performances by both tax-exempt and taxable money market funds. The trend indicates that market participants are currently adopting a defensive stance, reflecting an evolution in investment strategy as they wait for clarity on monetary policies. According to market analysts, as conditions stabilize and interest rates potentially decline, there is a likelihood that some investments will be reinvested into more traditional fixed-income markets.

Kim Olsan, a senior fixed-income strategist at NewSquare Capital, observes that the prolonged anticipation of the Federal Reserve’s first rate cut in nine months has resulted in a defensive investment tone among market players. The allure of higher short-term interest rates has rendered money market funds and short-dated bonds appealing. The latest figures from the Money Fund Report, published by EPFR, reveal that tax-exempt money market funds witnessed an influx of $3.2 billion in a single week, signaling robust investor interest. This surge brought the total assets in tax-exempt funds to an impressive $136.84 billion for the week that ended on Wednesday, a marked increase from earlier this year.

Prior to the COVID-19 pandemic, money market fund assets were predominantly situated around the $2 trillion to $3 trillion range; however, the onset of COVID-19 triggered a massive flight to liquidity, prompting a significant leap in these figures. Eric Golden, CEO of Canopy Capital Group, explains that the rise in money market fund assets was further amplified by the Fed’s rate hikes, making these vehicles increasingly attractive to investors. As a result, the current landscape boasts over $6.5 trillion allocated in various money market funds.

A critical observation was made regarding the current yield curve, which remains inverted—a distinction from scenarios observed in prior years, such as 2016 and 2020. Olsan notes that the gap between money market rates and long-term 10-year yield rates is approximately 50 basis points, with tax-exempt money market rates hovering around 3.50% and 10-year high-grade yields just exceeding 3.00%. Such yield curve dynamics play a substantial role in influencing investor behavior in the market, driving a cautious outlook among participants.

This inversion encourages investment decisions characterized by short-term holdings in money market funds rather than committing capital to longer-dated securities. Olsan argues that the extended maintenance of this inversion may continue to drive inflows into money market funds, postponing investor commitments to longer-dated bonds while they wait for more favorable economic indicators.

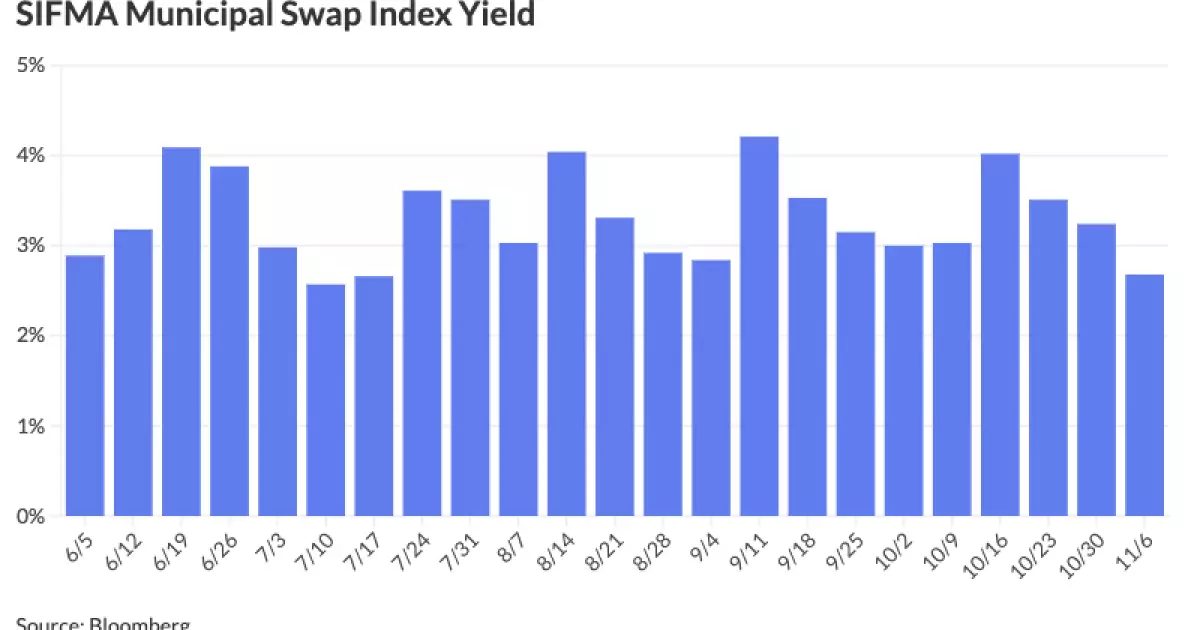

According to Rick White, an independent consultant, while there has been gradual growth in money market fund assets, the path remains rife with volatility. The cyclical inflow of capital appears to fluctuate significantly, leading to rapid changes in daily rates. In the opening days of November, capital poured into money market funds, which precipitated an immediate reaction in daily rates. However, positions quickly diminished, and as of late, rates have started to climb incrementally.

The SIFMA Swap Index, a key benchmark in money markets, recently declined to 2.68% from a preceding 3.24%. Such trends suggest a transition toward greater stability, which market participants are eager to see solidified. White emphasizes that the influx of capital and the present positioning of the SIFMA Index signify positive developments aimed at stabilizing a market that has endured significant rate volatility in recent years.

Golden highlights that the pivotal factor dictating the flow of funds will be the pace at which the Federal Reserve enacts rate reductions. The markets reacted unexpectedly to earlier Fed rate cuts, as the economy presented signs of strength despite initially higher inflation. Golden contends that as the Fed responds to economic data with rate cuts—whether swiftly or gradually—money market yields will adjust accordingly. He predicts that the liquidity released will not merely funnel into equities or bonds, but rather distribute across a diverse range of asset classes.

The prevailing sentiment suggests that the capital exiting money market funds will likely gravitate toward the bond space, with particular emphasis on municipal products for higher tax bracket investors. However, White expresses uncertainty regarding whether the conclusion of the election cycle will substantially affect the behaviors of market participants in their investment strategies.

As volatility looms over the financial landscape, market players will continue to monitor developments closely. Olsan asserts that significant outflows from money market funds into longer-maturity assets will become feasible only if U.S. Treasury yields substantially decrease. Meanwhile, for both individual and institutional investors, the overarching theme is one of resilience and adaptability in face of ever-changing economic conditions. The fluidity of investments amid these market dynamics will ultimately dictate the relative growth trajectories of money market and fixed-income options moving forward.