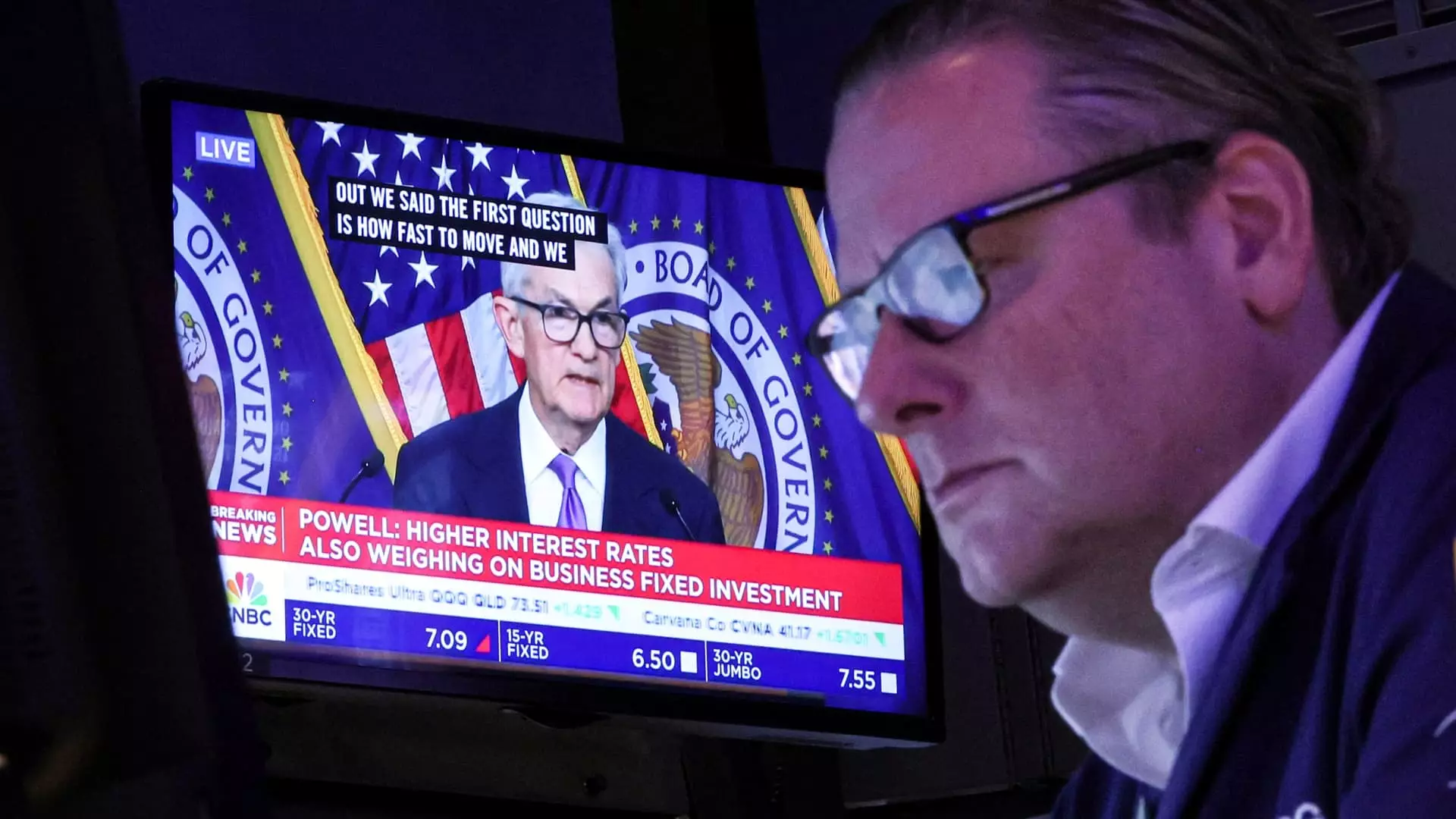

The Federal Reserve (Fed) is on the brink of enacting yet another interest rate reduction, anticipated to occur on December 18 following a two-day meeting. This decision represents a continuation of the Fed’s trend of lowering rates for the third consecutive time. Since September, these adjustments have collectively reduced the federal funds rate by a full percentage point. This cautious approach is a marked contrast to the swift rate hikes seen earlier when inflation reached a staggering 40-year high. Observers like Jacob Channel, a senior economic analyst at LendingTree, suggest that this upcoming cut might signify a pause in the Fed’s actions as they await further clarity on economic policies under President-elect Donald Trump.

Interest rates set by the Fed, though primarily affecting interbank lending, have a significant ripple effect on consumer borrowing costs. A reduction in the federal funds rate—potentially lowering it to a range of 4.25%-4.50%—is expected to ease financial pressures for some consumers. Nevertheless, not all borrowing costs will reflect this cut proportionately. Brett House, an economics professor at Columbia Business School, points out that certain essential interest rates that consumers face do not directly correlate with the Fed’s benchmarks, leading to a mixed outlook for consumers in terms of relief from their financial burdens.

The credit card industry is particularly sensitive to changes in the Fed’s rate policy. Rates on variable-rate credit cards have seen an upward trajectory, climbing from an average of 16.34% in March 2022 to approximately 20.25% recently, based on data from Bankrate. Despite the Fed’s rate cuts initiated in September, there has been minimal movement in average credit card rates. Financial experts note that credit card issuers often take a more cautious approach, adjusting rates downwards more slowly than they do when faced with rate hikes. Experts like Greg McBride, chief financial analyst at Bankrate, encourage consumers trapped in credit card debt to seek 0% balance transfer options rather than relying on potential future rate cuts to alleviate their financial woes.

In contrast to credit cards, mortgage rates tend to be more resistant to changes in the federal funds rate. Most mortgage agreements—especially 15- and 30-year fixed loans—are primarily influenced by Treasury yields and overall economic conditions rather than direct Fed actions. As of early December, the average rate for a 30-year mortgage hovers around 6.67%, only slightly lower than the alarming peak observed earlier this year. Experts forecast continued fluctuations in mortgage rates, making it challenging for potential homebuyers to predict the best time to secure a loan. As Jacob Channel indicates, the uncertainty in mortgage rates will persist, underscoring the necessity for homebuyers to remain agile.

Auto loans present another dimension of the interest rate discussion. While these loans typically have fixed rates, rising vehicle prices have led to heightened monthly payments, which can strain budgets. With average financing amounts approaching $40,000, even lower interest rates may not substantially alleviate the financial burdens faced by consumers. High car prices coupled with elevated financing amounts effectively overshadow any modest benefits that might accrue from lower interest rates.

Student loans add further complexity to the interest rate landscape. Federal student loans typically carry fixed rates, shielding most borrowers from immediate impacts resulting from Fed rate cuts. However, private loans, depending on their structure, may see some relief through variable rates tied to changes in federal benchmarks. Higher education expert Mark Kantrowitz notes that borrowers may eventually benefit from refinancing into lower-rate loans if they hold existing variable-rate private loans. Nonetheless, transitioning federal loans to private options involves significant trade-offs regarding the loss of federal protections and potential long-term costs.

Although the Fed’s rate cuts primarily impact borrowers, savers can still find positives amid these changes. Even with the Fed’s increasing rate strategies over the past several years, high-yield online savings accounts remain an appealing option for consumers, offering returns nearing 5%. Financial analysts highlight that this moment could be particularly advantageous for savers, emphasizing the importance of weighing the benefits of holding cash against the broader economic landscape.

As the Federal Reserve navigates its dual mandate of fostering maximum employment while maintaining price stability, the implications of its interest rate maneuvers continue to resonate throughout the economy. The cautious pace of rate adjustments reflects a broader strategic vision aimed at stabilizing the economic environment amidst an unpredictable fiscal landscape. As consumers brace for potential changes in their financial circumstances, the intersection of interest rates and individual financial products will require ongoing vigilance and adaptability.