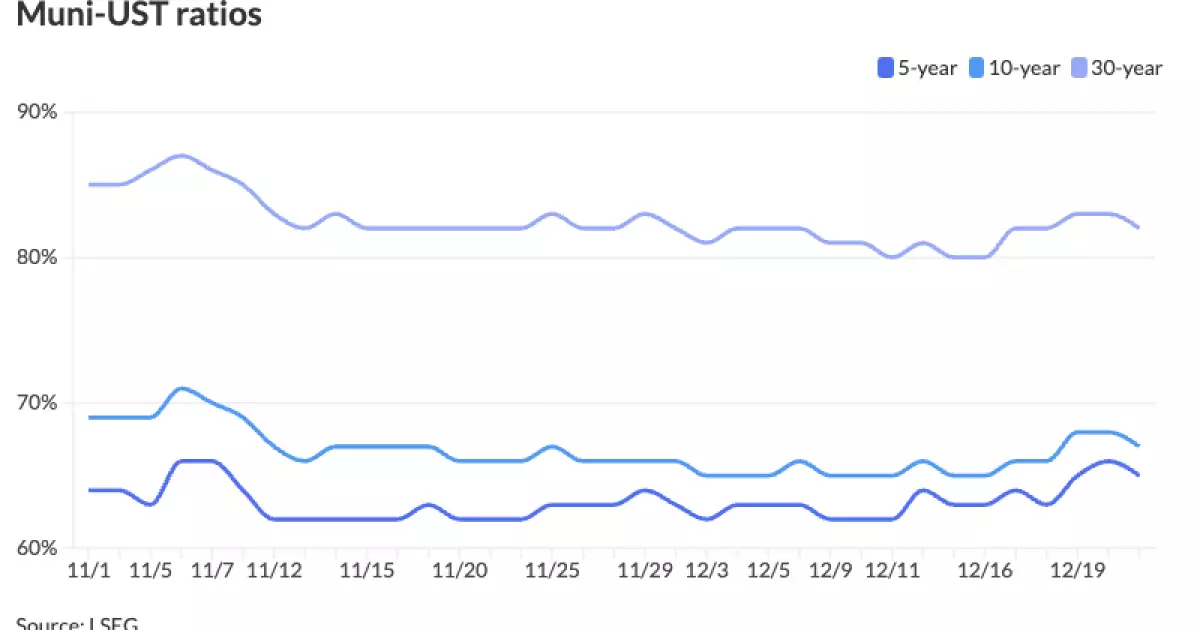

As the holiday season approaches, the municipal bond market is experiencing a period of relative stability, albeit amidst rising U.S. Treasury yields and mixed performance in equities. The municipal bond ratios continue to reflect significant shifts, highlighted by the two-year municipal-to-U.S. Treasury (UST) ratio standing at 64%, and climbing to 67% for the ten-year bonds. This development illustrates the dynamics at play in the fixed income market, where changes in Treasury yields are influencing municipal bond pricing and investor sentiment.

The recent communications from Federal Reserve Chairman Jerome Powell have prompted concerns regarding future interest rate cuts, with Powell advocating for a more cautious stance in monetary policy. According to Jason Wong, a vice president at AmeriVet Securities, this cautiousness coincides with a substantive uptick in municipal bond yields, which spiked an average of 23 basis points over the past week. This uptick not only reflects broader market trends but has also contributed to a reversal of previous positive gains in the municipal market, which had stood at a respectable 2.88% earlier in the year. Over the past month, however, losses have been recorded at 1.76%, diminishing year-to-date returns to a mere 0.74%.

The pronounced increase in yields, particularly within the 2038-2040 maturity range, which saw a jump of 27 basis points, plays a crucial role in shaping investor strategies and market performance. These shifts indicate a need for reconsideration of risk appetite among municipal bond investors, especially as they navigate these volatile yields.

The municipal bond market is currently dealing with a complex balance of supply and demand. According to industry experts like Matt Fabian from Municipal Market Analytics, the recent selloff has contributed some value back to the market. Still, it remains unclear whether this transient boost will evolve into a lasting rally. Fabian suggests that an anticipated surge in borrowing in the first quarter could curtail significant advancements in tax-exempt prices. A combination of rising Treasury yields and mounting supply concerns amplifies the uncertainty surrounding future bond pricing.

Strategists at Birch Creek note that the uptick in selling activity among investors is driven in part by typical end-of-year tax-loss harvesting strategies as well as notable outflows from mutual funds—an unusual occurrence as these funds typically attract capital rather than see it withdrawn. Recently, investors withdrew approximately $857 million from municipal mutual funds following $316.2 million in previous outflows, underscoring growing apprehension among bondholders.

The impact of mutual fund dynamics cannot be overlooked in this analysis. The ongoing trend of mutual fund outflows has naturally raised alarms regarding liquidity and investor confidence. J.P. Morgan analysts attribute some of these late-year outflows to the recent decline in U.S. Treasury rates, compounded by tax-related trading behavior. However, despite this trend, market dealers point out that the lack of eager buyers in a declining market has made it challenging to stabilize prices.

While dealers have taken steps to offload excess inventory, they remain reticent to aggressively bid, thus contributing to the downward pressure on municipal bond prices. The reluctance to engage in a “catch a falling knife” strategy signifies a cautious approach that many investors are taking during this period of uncertainty.

The yield curve for AAA-rated municipals reflects little change, although it underscores the shifting landscape of interest rates. With the 10-year yields registered at around 3.08% and the 30-year yields solidifying at approximately 3.92%, the stability at the longer end of the curve stands in stark contrast to the fluctuations experienced in shorter maturities. This stability is crucial as it sets the tone for investor expectations, particularly as they weigh the prospects of future rate adjustments.

As the holiday season approaches, the municipal bond market finds itself at a critical juncture, characterized by rising yields, fluctuating bond ratios, and rather unsettling mutual fund outflows. Investors must navigate this tangled web of challenges, balancing cautious optimism against a backdrop of volatility driven primarily by Federal Reserve signals and prevailing economic uncertainties. The coming weeks will undoubtedly shape the market’s trajectory as stakeholders watch for clearer signals amidst the bubbling complexity of the financial landscape.