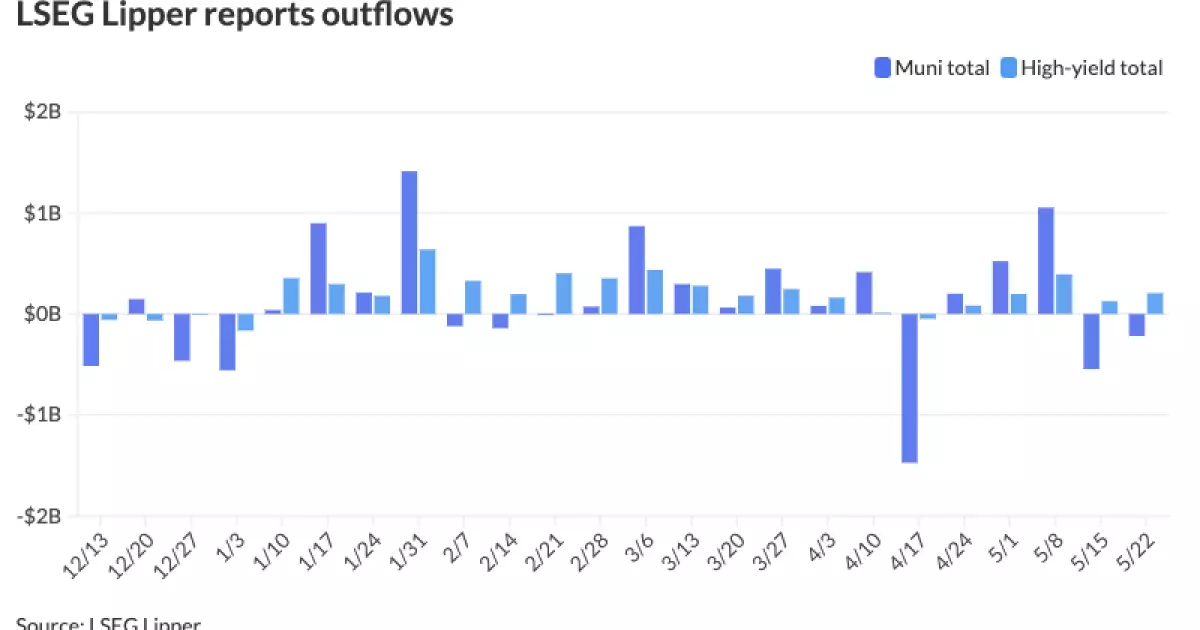

Municipal bonds experienced a significant sell-off on Thursday, with noticeable changes across the curve. This adjustment comes as a correction hits the asset class just before the summer reinvestment period. U.S. Treasuries and equities also saw losses during this time. Moreover, there was a continuation of outflows from municipal bond mutual funds for the second consecutive week, indicating a lack of confidence from investors in this market. On a positive note, high-yield bonds managed to maintain their strength with notable inflows, showcasing a glimmer of hope amid the uncertainty.

The market correction has led to a notable increase in triple-A yields, particularly in the front end and the belly of the curve. According to Barclays strategists Mikhail Foux and Clare Pickering, these yields have risen by as much as 13 to 17 basis points since the beginning of the week. This rise in yields has also resulted in a significant increase in muni-to-UST ratios across different maturity points. The two-year ratio, for example, reached 67%, while the 30-year ratio climbed to 84%. Such shifts in ratios have not been seen since late 2023, indicating a period of volatility and uncertainty in the market.

Supply and Demand Dynamics

One of the primary reasons behind the recent selloff is attributed to the oversupply of municipal bonds in the market. With seven consecutive weeks of significant supply levels, investors are finding it challenging to absorb the excess inventory. Additionally, fund inflows have been weak, further exacerbating the situation. This lack of demand, coupled with oversupply, is causing institutional investors to remain cautious and refrain from entering the market. The upcoming Memorial Day holiday is expected to reduce supply temporarily, but the overall outlook remains subdued due to various market factors.

Looking ahead, analysts predict heavy issuance in the summer leading up to the November elections. This influx of new bonds could put additional pressure on the market, affecting investor sentiment and market dynamics. Historically, the month of June has not been favorable for tax-exempt investors, with ratios widening and market conditions remaining challenging. As a result, there is a cautious outlook on market activity in the coming months. Despite the recent correction, municipal ratios still remain rich compared to historical levels, suggesting that there may be better entry points for investors in the future.

In the primary market, the pricing for Corpus Christi, Texas, showed changes in scales and yields across different maturity points. Despite the corrections in the municipal market, U.S. Treasuries also faced weakness, affecting various maturity points. FOMC minutes detailed discussions on the neutral rate and potential policy tightening, adding to the uncertainties in the market. While the Fed remains hopeful for a deceleration in inflation, policy decisions will be made cautiously based on market conditions and economic indicators.