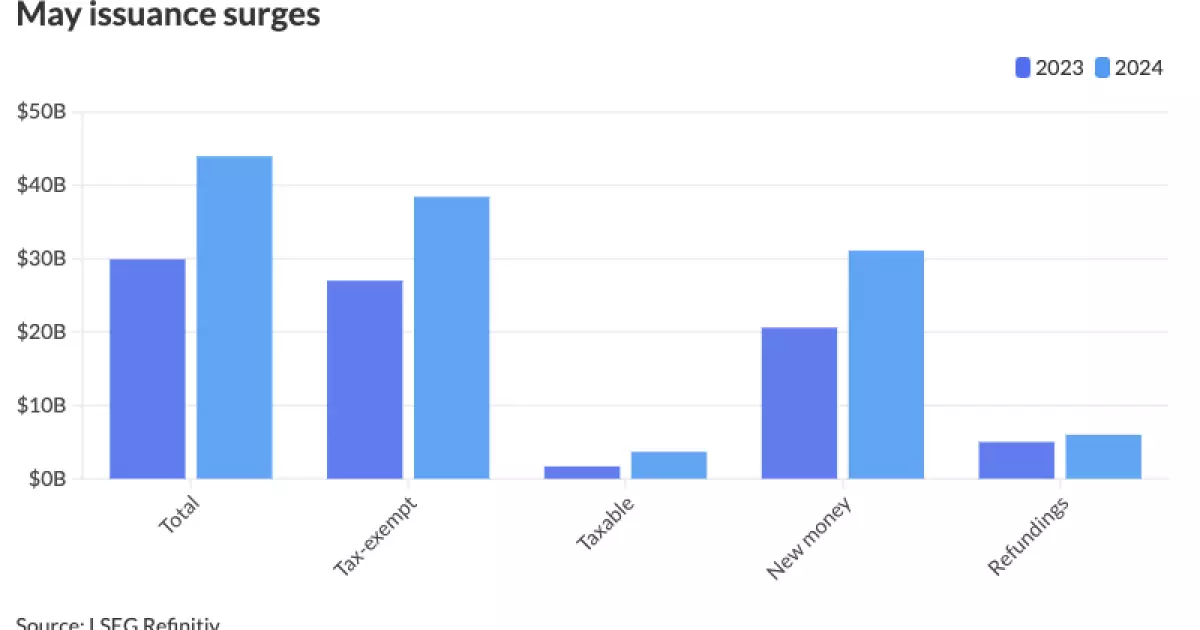

In May, issuance volume surpassed $40 billion for the month, which was the first time since 2016. The volume totaled $43.957 billion in 866 issues, showing a significant increase of 46.9% from the previous year. This boost in issuance is attributed to several factors such as the uncertainty surrounding Fed policy, pent-up capital needs, and the involvement of mega deals in the market. According to Matt Fabian from Municipal Market Analytics, the issuance in 2024 is considered the “strongest” in a decade, with year-to-date issuance totaling $191.353 billion, reflecting a 33.5% increase from the previous year.

Market participants have accepted the “psychological hurdle” that rates will not return to their previous levels, prompting issuers with deferred and new-money needs to tap into the capital markets. Mega deals, like the ones from Illinois and the New York City Transitional Finance Authority, have significantly contributed to the surge in issuance volume. Additionally, favorable financial conditions and the tax-exemption advantages have encouraged more issuers to enter the market with large deals that have been in the works for years.

The issuance is expected to remain elevated in the coming months, with June historically being the second highest monthly volume after October. Despite the high levels of issuance, there are concerns about supply overhang in the market, especially with significant events like the Fed meeting, Consumer Price Index release, and the Juneteenth holiday coming up. However, June is anticipated to have a brisk start in terms of issuance, driven by the expected impact of these events on the market.

Tax-exempt issuance in May increased by 42.3% to $38.438 billion, while taxable issuance rose by 118.1% to $3.679 billion. Both new-money and refunding volumes saw significant growth, with revenue bond issuance rising by 51% to $28.885 billion and general obligation bond sales increasing by 39.6% to $15.072 billion. Negotiated deal volume was up by 65.5%, while competitive sales increased by 20.6%. In terms of state rankings, California claimed the top spot with $30.909 billion, followed by Texas, New York, Florida, and Massachusetts in the top five.

The surge in issuance volume in May reflects a combination of factors such as market acceptance of current rate levels, the involvement of mega deals, and favorable financial conditions. Issuers are capitalizing on the current market environment to access the municipal market for their borrowing needs. Looking ahead, the market is expected to see continued elevated levels of issuance, with June likely to maintain the momentum seen in May. As market dynamics evolve, issuers and investors will need to closely monitor the impact of economic events and policy changes on the municipal market.