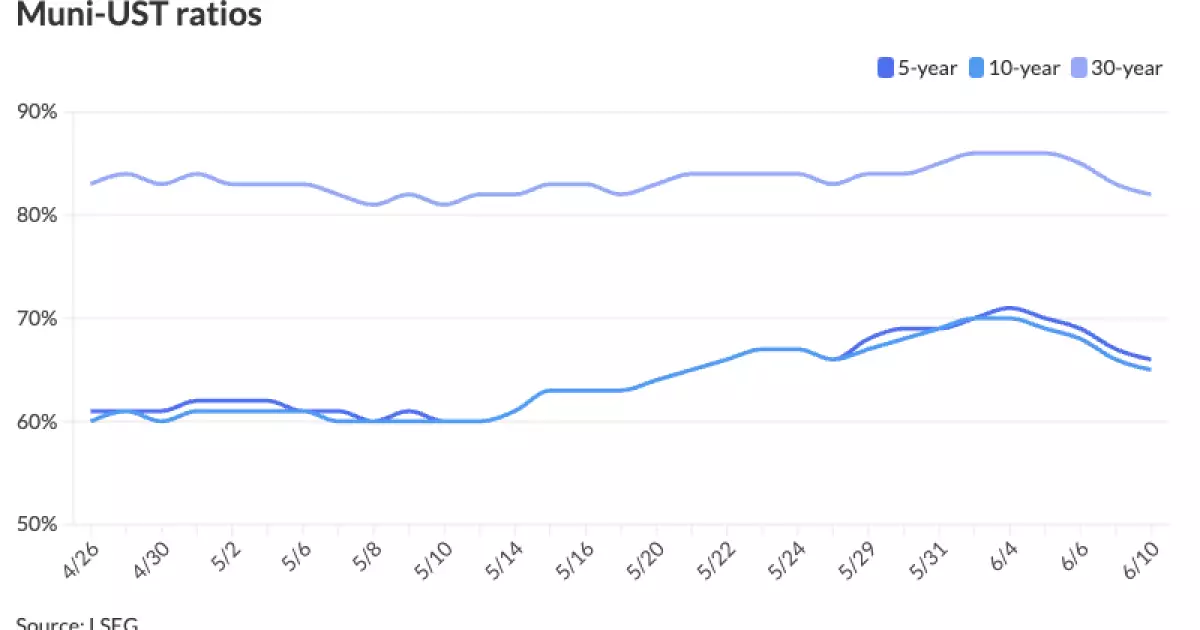

The municipal bond market showed little change on Monday, outperforming Treasuries as equities experienced slight gains. This relative stability in the muni market comes amidst anticipation for a smaller calendar, coinciding with an FOMC week. The muni-to-Treasury ratios across various tenors indicate an interesting trend, with yields in most of the curve starting the month at year-to-date highs. The recent rally in USTs preceding last week led to a turnaround in muni performance, with yields seeing a decline for the first time in three weeks.

The positive news for munis is reflected in the data, with the 10-year muni-to-UST ratio showing a favorable shift, further indicating a strong performance that surpassed expectations. The influx of cash from reinvestments provided reassurance to the markets and contributed to the recent rally. The changing sentiment among market participants, leading to a ‘short covering’ rally, showcases the unpredictability of investor behavior in response to market dynamics. Despite a significant new-issue calendar last week, the strong demand for deals and reinvestment cash injected into the market drove muni buyers to actively engage with attractive valuations.

The primary market activity on Monday saw accelerated issuance of gas supply revenue bonds, indicating ongoing deal flow despite a reduction in issuance for the week. The visible supply for the coming weeks includes several large deals, with notable issuances from the New York Transportation Development Corp. and Tennergy Corp. These upcoming deals reflect the continued interest in the municipal bond market and potential opportunities for investors seeking diversification and yield.

The various yield curves provided by Refinitiv MMD, ICE, S&P Global Market Intelligence, and Bloomberg BVAL offer insights into the current interest rate environment for munis and USTs. The slight changes in yields and scales highlight the nuanced movements in the market, influenced by factors such as supply, demand, and investor sentiment. Treasuries experienced weakness at the close, with different tenors showing varying degrees of yield changes, signaling potential shifts in market expectations and risk appetite.

The negotiated calendar for the week includes a diverse set of issuances from different entities, showcasing the breadth and depth of the municipal bond market. Notable deals from various sectors, such as transportation, education, and healthcare, reflect the ongoing funding needs of municipalities and organizations. The competitive pricing of these deals provides insights into investor demand, risk assessment, and market conditions that drive the issuance and pricing decisions.

The muni market’s performance and trends for the week indicate a mix of stability, positive investor sentiment, and ongoing deal activity. The market dynamics, influenced by a combination of macroeconomic factors, investor behavior, and regulatory events, underscore the importance of monitoring and analyzing data to make informed investment decisions in the municipal bond market.