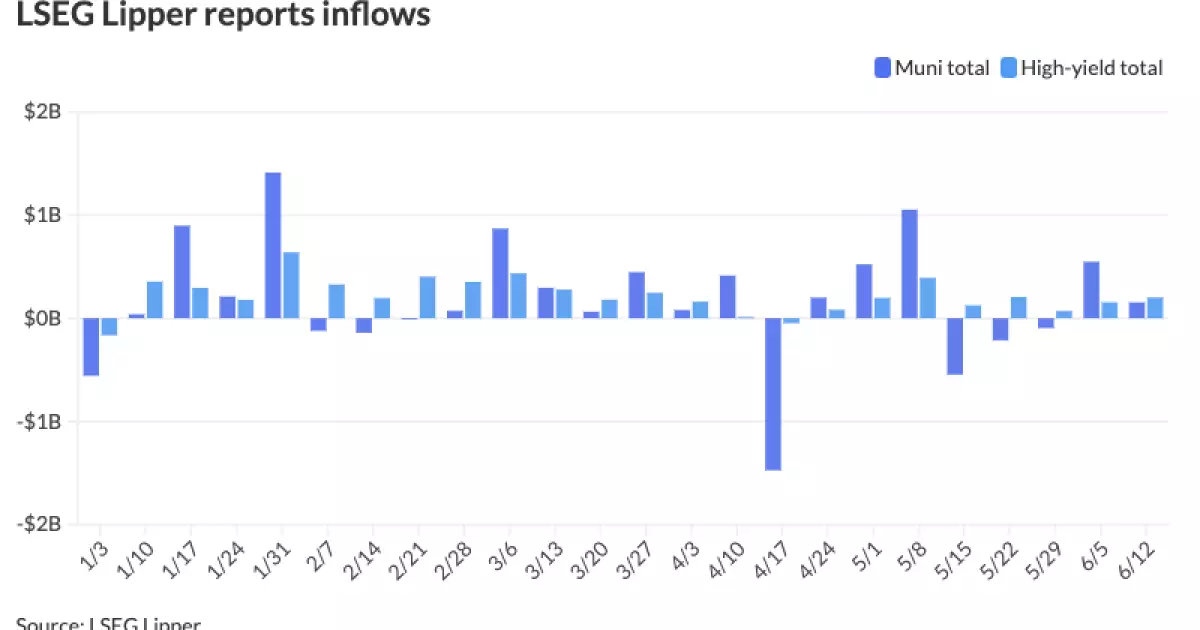

The municipal bond market experienced a day of firmness following a stronger U.S. Treasury session, with equities closing on a mixed note. Triple-A yields saw a decrease of one to five basis points while USTs recorded gains of seven to nine basis points. This movement led to an uptick in muni to UST ratios, with the two-year muni-to-Treasury ratio standing at 66%, the three-year at 67%, the five-year at 68%, the 10-year at 67%, and the 30-year at 85%. Municipal bond mutual funds witnessed inflows for the second consecutive week, with investors adding $154.2 million after the previous week’s inflow of $547.9 million.

J.P. Morgan strategists noted that base rates in the muni market have not kept up with the UST market rally. They observed that Triple-A high-grade muni yields have fallen behind USTs across most of the curve, despite rallying 23 to 28 basis points month-to-date. The strategists mentioned that absolute yields still appear attractive compared to historical ranges and recent underperformance against taxable fixed-income. Kim Olsan, Senior Vice President of municipal bond trading at FHN Financial, highlighted the challenges posed by UST gyrations in response to economic data and FOMC communications. She noted that the current cycle coincides with the beginning of summer seasonals, where a significant amount of maturities are scheduled to take place.

The recent strength post-CPI data affected the distribution of syndicate balances. Bonds traded close to AAA levels saw interest, leading to tighter secondary bidsides. Active trading was observed in various GOs from states like California, Massachusetts, Washington, and Connecticut, with notable tightening in yields. Olsan pointed out that price improvements have shifted the curve once again, pushing yields in certain durations above the 3.00% threshold. She anticipated increased demand in the 2039-2044 range and identified specific structures that may find support in the market.

In the primary market, BofA Securities priced bonds for the Health, Education, and Housing Facility Board of the County of Shelby, Tennessee, while Denton, Texas, conducted a competitive sale of GO refunding and improvement bonds. These transactions reflected ongoing activity in the municipal bond market, emphasizing the diverse range of issuers and structures available to investors.

Municipal CUSIP request volume increased in May compared to the previous year, showcasing sustained interest in the market. Texas led the state-level municipal request volume, followed by New York and California. AAA scales were adjusted slightly, with key yields showing movement in different directions across various platforms. This highlights the dynamic nature of the municipal bond market and the importance of staying informed about these fluctuations.

The municipal bond market continues to exhibit resilience and attract investor interest despite challenging economic conditions. Understanding the nuances of market movements, structural developments, and key indicators such as CUSIP requests and AAA scales is crucial for navigating this complex yet rewarding investment landscape.