The month of March saw a significant increase in municipal bond issuance for the third month in a row. This uptick was largely attributed to a surge in refundings and the completion of several billion-dollar deals. As economic conditions improved and demand for municipal bonds increased, issuers found themselves more confident in entering the market. This confidence was further supported by a shift of inflows into muni mutual funds, indicating a positive trend in investor sentiment towards municipal bonds.

Factors Driving the Increase in Supply

Several factors contributed to the rise in municipal bond issuance during March. Demand played a critical role, with issuers capitalizing on increased investor interest in municipal bonds. Economic conditions also played a significant role, with the economy showing signs of stability and growth, providing issuers with the necessary tailwinds to confidently take on additional debt. Furthermore, the completion of several billion-dollar deals, such as those from California, New York City, and Washington, further boosted issuance volumes.

Breakdown of Issuance

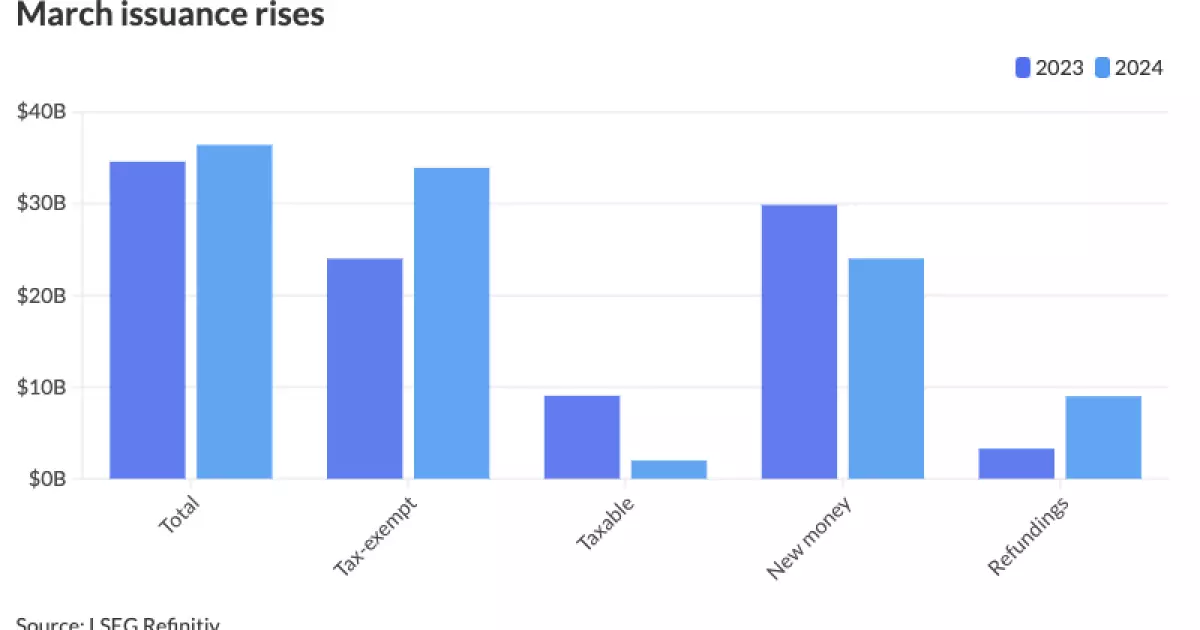

Tax-exempt issuance saw a significant increase during March, rising by 41.3% compared to the previous year. In contrast, taxable issuance experienced a sharp decline of 78%. The increase in tax-exempt issuance was primarily driven by the completion of several large deals, highlighting the continued appeal of tax-exempt municipal bonds to investors. Moreover, alternative-minimum tax issuance also saw a decrease, reflecting changing investor preferences and market dynamics.

Looking ahead, market participants anticipate a front-loading of issuance in the coming months, as issuers seek to enter the market before the November election. This spike in issuance is expected to continue throughout the year, driven by issuers feeling more comfortable borrowing in the current economic environment. With the likelihood of a recession decreasing and the Federal Reserve potentially cutting rates, issuers are poised to take advantage of a favorable market to meet their financing needs.

Regional trends in municipal bond issuance show a varied landscape, with states like New York, California, and Texas leading the way in terms of issuance volume. New York claimed the top spot year-to-date, with a significant increase in issuance compared to the previous year. California and Texas followed closely behind, showcasing strong demand for municipal bonds in these states. Other states, such as Massachusetts, Alabama, and Washington, also saw notable increases in issuance, highlighting the widespread appeal of municipal bonds across different regions.

The municipal bond market experienced a significant uptick in issuance during March, driven by increased confidence among issuers, strong investor demand, and favorable economic conditions. Despite challenges such as changing investor preferences and potential legal actions, the market remains resilient, with issuers adapting to meet evolving market conditions. Looking ahead, the outlook for municipal bond issuance remains positive, with issuers poised to capitalize on a favorable market environment to meet their financing needs.