The recent selloff in the U.S. Treasury market has created pressure on municipals, but they managed to outperform their taxable counterparts. This outperformance can be attributed to investors flocking to equities in a risk-on trade due to better economic data. As a result, triple-A yields rose moderately, whereas UST saw significant losses on the short end. This movement in the market resulted in lower municipal to UST ratios, with various ratios showing a decline after the day’s trading.

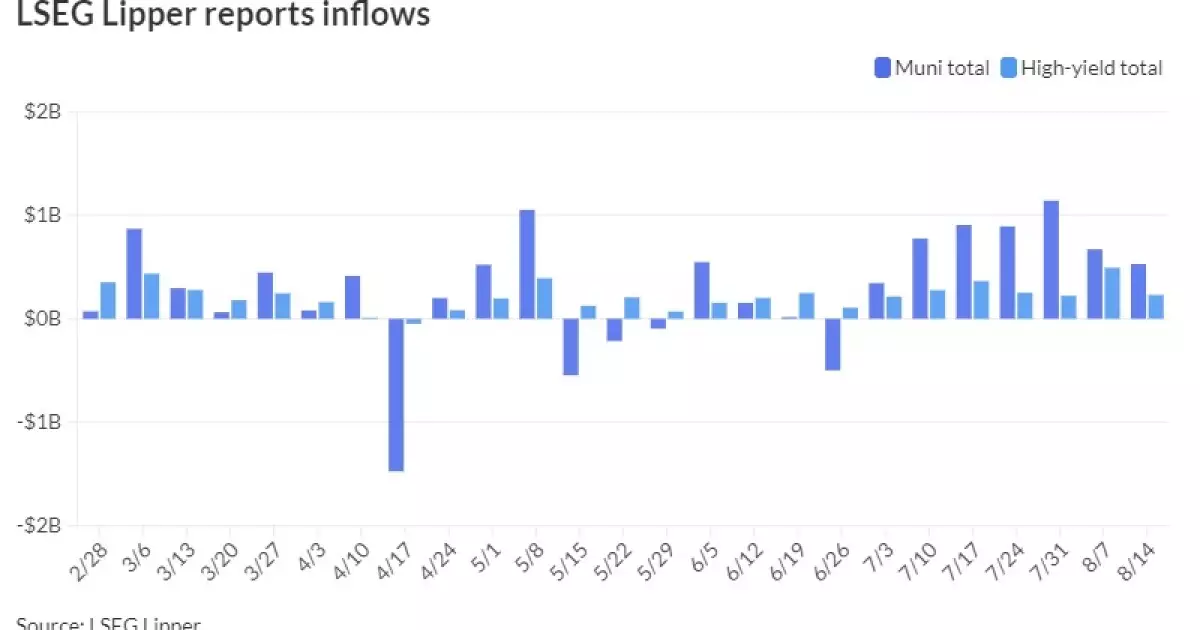

Municipal bond mutual funds experienced inflows as investors added a substantial amount to funds, marking seven straight weeks of inflows. High-yield bonds continued to exhibit strength with consistent inflows. In the primary market, the final large deals of the week were priced and even upsized in some cases, indicating robust investor demand.

Several significant deals were priced in the primary market, including the Triborough Bridge and Tunnel Authority, the New Jersey Health Care Facilities Financing Authority, and the Reno-Tahoe Airport Authority. These deals consisted of various bonds with different maturities and yields, catering to different investor preferences.

Market Supply and Demand Dynamics

The Bond Buyer 30-day visible supply grew significantly, coinciding with substantial reinvestment cash entering the market. This influx of cash is expected to boost demand, especially in the 1-10 year portion of the market. The reinvestment credits being received are crucial for determining the market direction and yield movement.

Market analysts have observed that short yields are aligning more closely with the 10-year range, resulting in a narrower yield spread between different bond maturities. While there is a positive slope in the 5-10 year maturities that is attracting flows, the longer curve slope remains favorable for extension based on the rate outlook for the next six to 12 months.

As the fall season approaches, there are continued opportunities to buy bonds, especially in anticipation of weaker election-related municipal market technicals. The upcoming new-issue calendar offers long-dated maturities across different names, providing investors with a range of choices. However, challenges related to market technicals and upcoming events may influence market dynamics in the near future.

Analysis of AAA Scales and Yield Curves

Various scales such as Refinitiv MMD, ICE AAA, S&P Global Market Intelligence, and Bloomberg BVAL showed different movements in yields across different bond maturities. The adjustments in these scales reflect the changing market dynamics and investor sentiment.

The municipal bond market is influenced by various factors such as economic data, investor behavior, market supply and demand, and rate outlook. Understanding these dynamics and trends is essential for investors and market participants to make informed decisions and navigate the complexities of the bond market successfully.