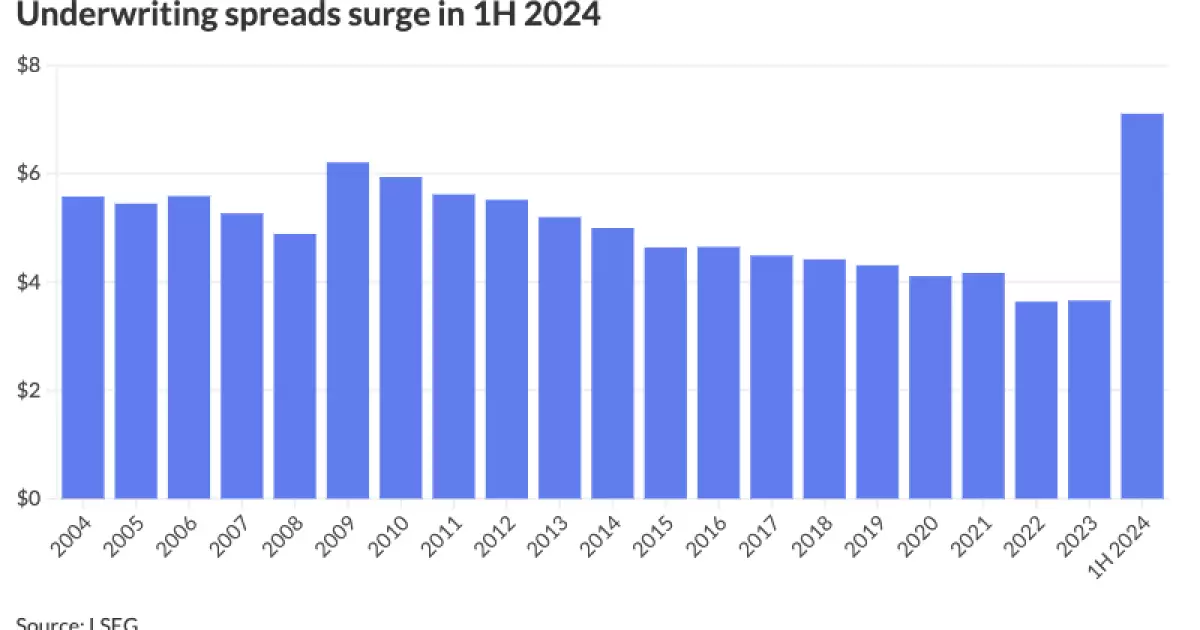

The underwriting spreads for all bonds have witnessed a significant surge in the first half of 2024, reaching beyond $7 for the first time in 25 years. This increase has been notable, with spreads rising to $7.11 in the first half of 2024 from $3.70 in the same period in 2023. Furthermore, spreads on negotiated bonds increased to $6.55 in the first half of 2024 from $3.78 in the prior year, while spreads on competitive deals spiked to $9.08 from $2.61 in 1H 2023, according to data from LSEG. This surge in underwriting spreads has implications for the bond market as a whole.

One of the primary reasons behind the increase in underwriting spreads is the composition of deals entering the market. Wesley Pate, a senior portfolio manager at Income Research + Management, mentioned that underwriting costs can vary significantly based on the volume and size of deals. The current trend of a higher number of smaller deals hitting the market has led to a natural increase in underwriting costs. This has been particularly evident in the rise of voter referendum passed deals, contributing to the overall spike in underwriting spreads.

Matt Fabian, a partner at Municipal Market Analytics, highlighted the changing dynamics in the primary market, where space is becoming more premium. Dealers are facing challenges in distributing bonds quickly, primarily due to the reliance on separately managed accounts (SMAs). This shift has resulted in dealers taking on more price risk, ultimately leading to the uptick in underwriting spreads. The recent exits of major players like Citi and UBS from the underwriting business have also impacted the overall competitiveness in the market, further influencing the rise in spreads.

The increased issuance in the bond market, up by 32.3% to $242.162 billion in the first half of 2024, has added to the pressure on underwriting spreads. With SMAs being the dominant distribution channel and uncertainty surrounding future interest rates, dealers are carrying more risk than before. As rates continue to rise and market participants face unpredictability in bond prices, the widening of underwriting spreads seems inevitable. This trend is likely to continue into the second half of the year, especially if market conditions remain volatile.

Some analysts view the current $7.11 figure as an outlier rather than a sustained trend of higher underwriting spreads. Anticipating a revision that could bring rates back to a long-term average, there is optimism that the market will stabilize. Despite the challenges posed by narrower margins and increased risk, rising underwriting spreads have been perceived as a beneficial change. Anthony Tanner, a research analyst and market strategist, mentioned that in the current economic environment, a slight shift in yields can significantly impact profitability. Therefore, the increase in underwriting spreads is seen as a positive development that aligns with the evolving market landscape.

The surge in underwriting spreads for bonds in 2024 reflects the complex interplay of market forces, participant behavior, and external factors. While the increase presents challenges for dealers and investors, it also indicates a necessary adjustment to the current market conditions. As the bond market continues to evolve, adaptability and strategic decision-making will be crucial for navigating the shifting landscape of underwriting spreads.