The municipal bond market stands as a critical barometer for investors seeking stability and risk-adjusted returns, especially as Thanksgiving approaches and the trading environment shifts. This article analyzes recent trends in the municipal bond market, examining the implications of technical market dynamics, shifting investor strategies, and anticipated supply levels as the year edges towards its conclusion.

As the municipal bond market prepares for a shortened trading week due to Thanksgiving, recent performance indicates a period of relative stability. Although market trading has seen light activity, it has remained largely unchanged for over a week, with key technical indicators aligning favorably for municipal bonds versus U.S. Treasuries and corporate bonds. A notable trend is the lack of significant fluctuations in triple-A municipal bond yields, which have maintained their levels for nine trading days, reflecting an overarching cautious optimism among investors.

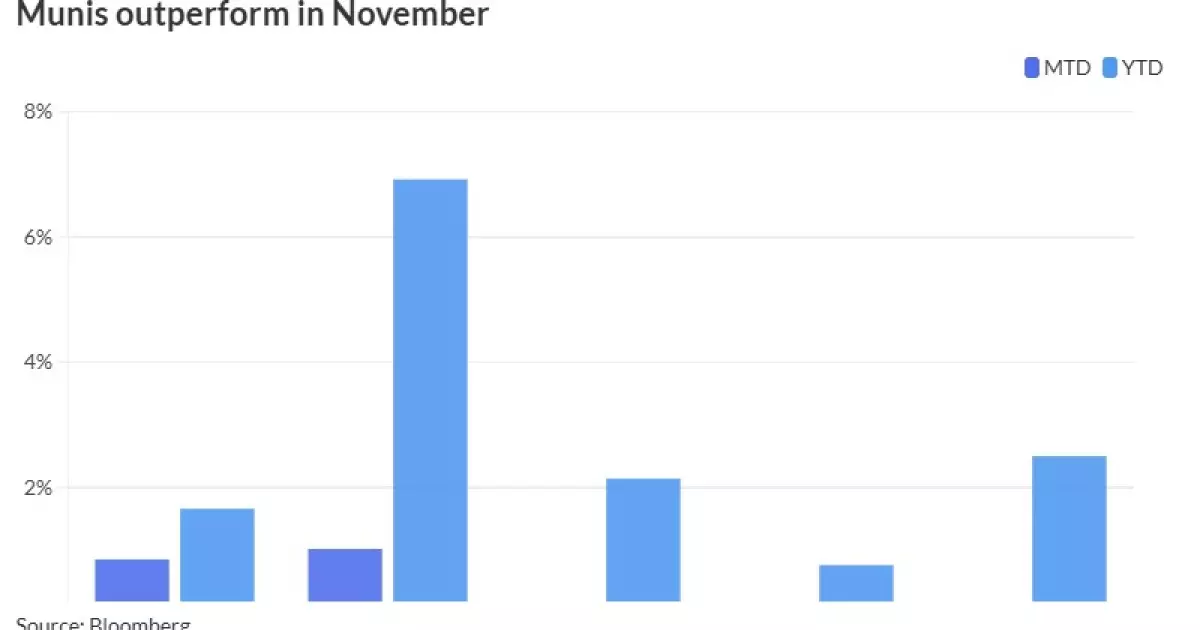

Peter DeGroot, an influential figure in municipal research at J.P. Morgan, has highlighted that the municipal market has demonstrated a form of reprieve this November. This has facilitated outperformance against Treasuries and corporate debt, a situation that many bond market players find advantageous. As the supply of municipal bonds diminishes significantly, dealers have had the opportunity to reassess their positions, leading to more favorable pricing and less urgency to dump inventory in a volatile rate environment.

While the stability appears promising, player sentiment remains measured. Mikhail Foux from Barclays has noted that despite robust demand for tax-exempt municipal bonds, investor enthusiasm has not reached frenzied levels traditionally seen in buoyant markets. The ratios that often dictate bond attractiveness are currently considered less favorable, which has tempered trading volumes across the market. Investors are increasingly vigilant regarding the balance between risk and return—hawkish monetary policies and looming tax changes may further complicate the landscape.

Several municipal tax-exempt ratios were reported at 60% for two-year bonds and 82% for thirty-year bonds, indicating a narrowing spread when compared to corporate bonds. Although technical conditions are supportive, market players are approaching new issuances with caution, preferring to focus on primary market entries rather than speculating on performance rebounds in the abbreviated trading week.

Looking ahead, the municipal market anticipates a slightly more substantial supply week post-Thanksgiving with an estimated $1.4 billion in new issuances. This influx comes as November culminates in a dynamic period for these financial instruments, with Bond Buyer data indicating a visible supply of $6.91 billion. However, the net negative supply forecast for December, dropping from $17 billion to $3 billion, suggests that market conditions will remain complex—potentially hindering a repeat of November’s relative gains.

Historical data indicates that December could offer a positive backdrop for high-grade municipal bonds. Foux notes a consistent pattern over the past decade where high-grade funds have maintained positive returns, reminding investors that the month often grants the market buoyancy as year-end adjustments occur. The average return for high-grade municipals in December has been approximately 0.9%, indicating a robust seasonal tendency toward outperformance.

As macroeconomic indicators take center stage, attention will remain fixed on critical data such as the core Personal Consumption Expenditures (PCE) price index, which could influence subsequent decisions by the Federal Open Market Committee (FOMC). The current futures market projects a modest 25 basis-point cut as a probable outcome, reflecting the precarious balancing act between stimulating growth and managing inflation.

Foux’s economic outlook remains optimistic, projecting an encouraging GDP growth of 2.8% for the third quarter. This perspective underlines the resilience of the economy, which remains essential for sustaining demand within the municipal bond market—a sector keenly responsive to economic shifts.

Despite the enthusiasm heading into the final segments of 2024, caution is urged for 2025. Industry leaders recognize that while December may see favorable conditions and potential for income generation, the outlook beyond presents challenges, with valuations and market volatility likely becoming prominent concerns.

As we navigate this Thanksgiving week, the municipal bond market reflects a blend of cautious optimism interspersed with pragmatic concern. The trends observed thus far suggest a period of careful navigation is required for municipal investors, who must balance the allure of year-end performance against potential macroeconomic disturbances that could reshape the landscape in 2025 and beyond.