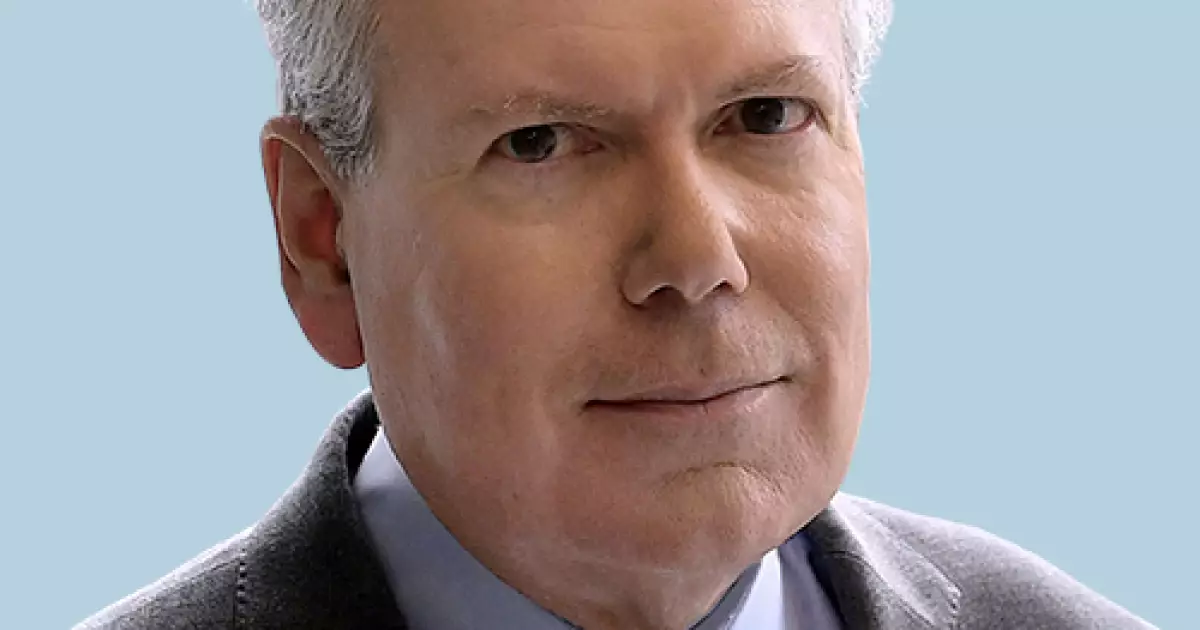

A recent court decision by Judge Stephen Bough of the U.S. District Court for the Western District of Missouri has struck down a pair of year-old Missouri investment rules that regulated “non-financial” investment advice from broker-dealers and investment advisors. This ruling has sparked controversy and debate among various stakeholders in the financial industry.

The court ruled in favor of Securities Industry and Financial Markets Association (SIFMA) on all four counts, leading to a statewide permanent injunction on the implementation, application, or enforcement of the rules. The rules required broker-dealers and investment advisors to disclose and obtain written consent from customers for investment products based on environmental, social, or other non-financial objectives. However, the court found that these rules were preempted by federal laws, including the National Securities Markets Improvement Act and the Employment Retirement Income Security Act.

The court’s decision has significant implications for the financial industry in Missouri. It raises questions about the extent to which states can regulate non-financial investment advice and the potential conflicts between state and federal laws in this area. The ruling also highlights the need for clarity and precision in regulatory frameworks to avoid constitutional challenges.

Missouri Secretary of State John R. Ashcroft and Missouri’s Securities Commissioner Douglas Jacoby, who were named as defendants in the lawsuit, expressed disappointment with the court’s decision. They argued that the ruling puts Missouri investors at risk and undermines the state’s ability to regulate securities effectively. On the other hand, SIFMA hailed the decision as a victory for investor choice and freedom of speech.

The court’s decision on the Missouri investment rules has far-reaching implications for the financial industry in the state. It serves as a reminder of the complex interplay between state and federal regulations in the investment advisory space. Moving forward, it will be important for regulators and policymakers to strike a balance between investor protection and regulatory clarity to ensure a fair and transparent financial market for all stakeholders.