In the midst of a fluctuating financial landscape, municipal bonds have remained relatively stable. The recent shifts in U.S. Treasuries and stock market performance have influenced the state of municipal bonds. Despite the ongoing impact of external factors, muni yields have sustained levels similar to those observed in the previous summer. This steadiness in yields has garnered attention from industry experts, including Tom Kozlik, who foresees the potential for lower yields following communications regarding Federal Reserve policy adjustments.

Issuance and Demand

The municipal bond market has seen a steady flow of issuance, totaling $277.228 billion year-to-date, reflecting a modest increase compared to the previous year. While the upcoming month of August is expected to bring a slowdown in issuance due to seasonal factors, such as summer vacation, the market also anticipates a decrease in supply leading up to the November election. The combination of reduced supply and market conditions suggests that muni paper may not experience significant fluctuations in value in the near future.

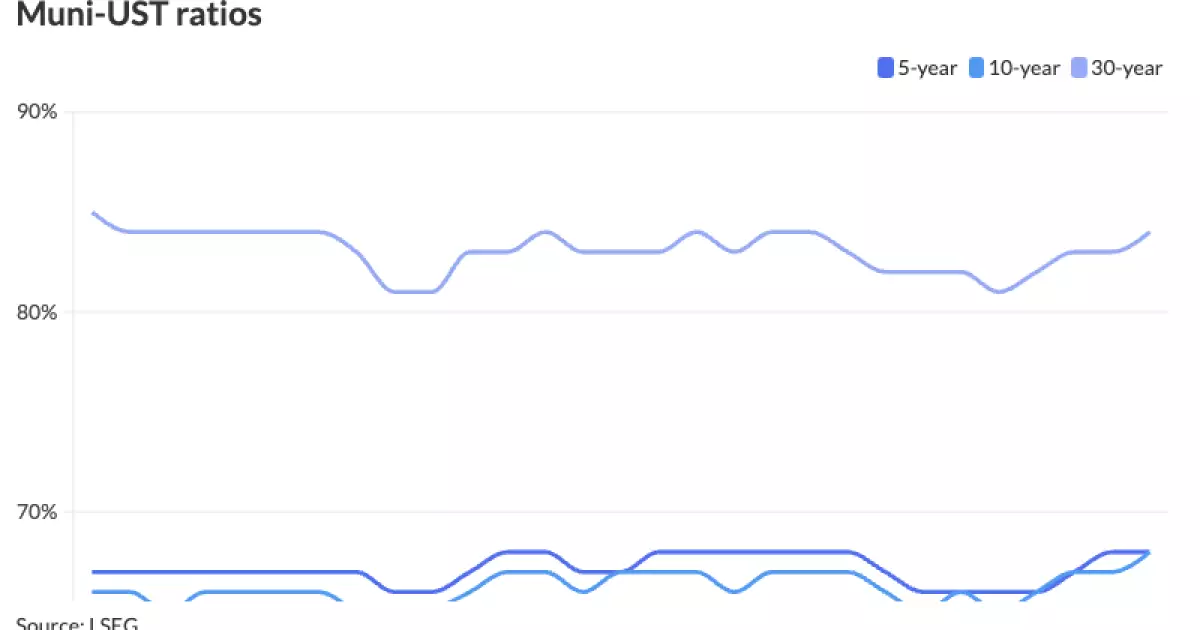

Ratio Analysis and Market Dynamics

When examining the muni-to-Treasury ratios, it is evident that the market is lacking compelling buying opportunities. The ratios for various maturity periods remain relatively stable, indicating a lack of attractive investment prospects. Despite this, there has been a notable influx of demand from institutional muni funds, hinting at a potential acceleration in demand as expectations for rate easing grow. These market dynamics underscore the importance of monitoring supply and demand dynamics to anticipate future trends in the municipal bond market.

Several notable transactions have taken place in the primary market, with institutions pricing significant amounts of municipal bonds. Noteworthy deals include GOs for New York City, AMT Portland International Airport revenue bonds, Inova Health System Project healthcare revenue bonds, and more. These transactions reflect a diverse range of issuers and bond types, highlighting the breadth of opportunities available in the municipal bond market.

Yield Curve and Interest Rate Trends

As for yield curves and interest rates, various market indicators have demonstrated minor fluctuations. The AAA scales from Refinitiv MMD, ICE, S&P Global Market Intelligence, and Bloomberg BVAL have shown mixed movements across different maturity periods. Additionally, U.S. Treasuries have exhibited firmer yields, signaling potential shifts in the broader fixed-income market. These trends underscore the interconnectedness of different financial instruments and the need for a comprehensive understanding of market dynamics.

Looking ahead, market participants are preparing for upcoming bond issuances, both in the competitive and negotiated markets. Notable deals include the Port of Seattle’s intermediate lien revenue refunding bonds, Tallahassee’s energy system refunding revenue bonds, and other offerings from various municipalities. The diversity of issuers and bond types in these upcoming transactions highlights the continued activity and vibrancy of the municipal bond market.

The current state of municipal bonds reflects a blend of stability and potential for future shifts. The interplay between market dynamics, issuer activity, and external factors like interest rates and economic conditions underscores the complexity of the municipal bond market. By staying informed and proactive in monitoring these factors, investors and market participants can navigate the evolving landscape of municipal bonds and capitalize on emerging opportunities.