The municipal bond market has showcased a complex interplay of factors in recent weeks as capital flows and yields continue to evolve, reflecting both investor sentiment and macroeconomic trends. This article delves into critical developments within the municipal bond space, exploring inflow trends, market performances, and outlooks that could shape future investment strategies.

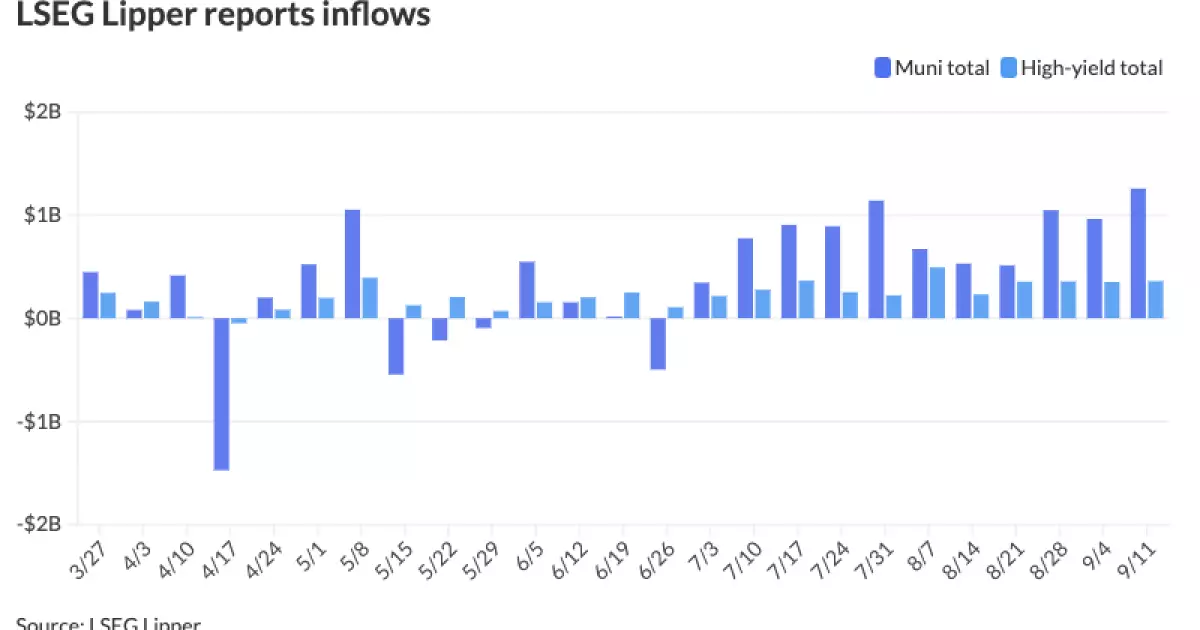

The municipal bond market experienced a noteworthy surge in inflows recently, with mutual funds attracting over $1 billion, marking the second-highest weekly total for the year. Investors added approximately $1.258 billion to municipal bond funds, following a previous week’s inflow of $963 million, as tracked by LSEG Lipper. This continued trend of inflows represents the 11th consecutive week that investors have shown interest in municipal bonds, a significant rebound after a challenging period that started with the Federal Reserve’s rate hiking cycle in early 2022.

The return of investor confidence can be attributed to the higher nominal yields offered by municipal bonds in comparison to their historical rates. Sam Weitzman from Western Asset Management pointed out that the municipal asset class has garnered around $27.3 billion in inflows this year, driven largely by a search for yield in a rising interest rate environment. In particular, long-duration and high-yield funds saw substantial attention, collectively amassing $35 billion through August, indicating that investors are increasingly willing to take on duration risk in pursuit of greater returns.

The Contrast in Historical Trends

Despite their recent strength, the current inflow cycle remains pale in comparison to historical averages observed before 2022. The Bloomberg Municipal Bond Index has faced challenges, showing an average performance of -2.0%. In stark contrast, previous inflow cycles had yielded average returns of approximately 12.4%, highlighting the dramatic shift in market circumstances over the past couple of years.

The marked difference in inflow size suggests potential room for growth as the Federal Reserve is expected to ease interest rates in the near future, potentially revitalizing investor appetite for municipal securities. The robust inflow cycle is tempered, however, by the significant outflows that have occurred from early 2022 through late 2023, with a staggering $122 billion withdrawn from the market. This backdrop could suggest a need for careful analysis and strategic positioning as the market recalibrates.

Market Ratios and Valuation Perspectives

Fundamentally, municipal bonds are currently positioned favorably against Treasuries, with various maturity ratios indicating value versus corporate debt. The two-year and 30-year municipal-to-Treasury ratios, hovering at around 64% and 88% respectively, reflect a strong comparative advantage for tax-exempt income. While these ratios are not at historic lows, they still present attractiveness, especially when viewed through a risk-adjusted lens compared to high-grade corporates.

J.P. Morgan analysts note that while there is potential for municipal ratios to cheapen further, the current valuations should be appealing to investors seeking taxable income than corporate alternatives. This attractiveness is amplified for long-duration bonds which face heightened demand as the prospect of falling rates could lead to capital appreciation.

Despite the recent revival in demand, the municipal market is simultaneously facing headwinds from increased supply. A notable rise in new issuances is anticipated leading up to the November elections as issuers seek to preemptively fund ongoing infrastructure projects without relying heavily on government aid. This shift requires issuing entities to appeal to capital markets directly, which can stress the market dynamics if coupled with increased volatility in Treasury yields.

Yet, the recent uptick in issuance could help maintain relative yield attractiveness, as several large projects are priced competitively. Chris Proctor from SS&C ALPS Advisors highlighted that the market’s resilience can be tested by the forward calendar of issuances, but this could also generate opportunities for discerning investors who can capitalize on strategic pricing.

The municipal bond market currently stands at a crossroads where historical data shines a light on both opportunities and vulnerabilities. Investors must navigate a landscape shaped by recent inflows and the potential for renewed demand driven by easing monetary policy. As issuers prepare to tap capital markets amid higher supply, strategic positioning will be fundamental for those keen on capturing promising municipal investments.

Hence, investors should lean on analytical frameworks to assess the risk-return profiles inherent in current municipal offerings, balancing their portfolios to capitalize on the emerging trends while remaining vigilant over market fluctuations. As the landscape develops, the interplay between yield, valuation, and capital flows will likely define the municipal bond market’s trajectory going forward.