In the landscape of pharmaceutical investments, Merck & Co. Inc. has emerged as a potent option for value-driven investors, particularly in light of recent statements from prominent investor Bill Nygren. Known for his analytical approach, Nygren’s endorsement of Merck highlights its strong portfolio attributes and resilient nature as a standalone entity. The current discount on its shares offers a compelling case for potential investors looking to capitalize on a promising opportunity, even amidst the current market fluctuations.

Merck’s stock has struggled to maintain momentum in recent months, showing a decline of over 5% year-to-date. This underperformance can largely be attributed to a drop in sales, particularly concerning its human papillomavirus vaccine, Gardasil, in the Chinese market. Such challenges present a significant contrast to the overall bullish trends of other sectors, causing some investors to question the stock’s viability. However, Nygren’s perspective provides an intriguing counter-narrative, asserting that the recent dip in stock price could be misleading and opens the door for strategic buying opportunities.

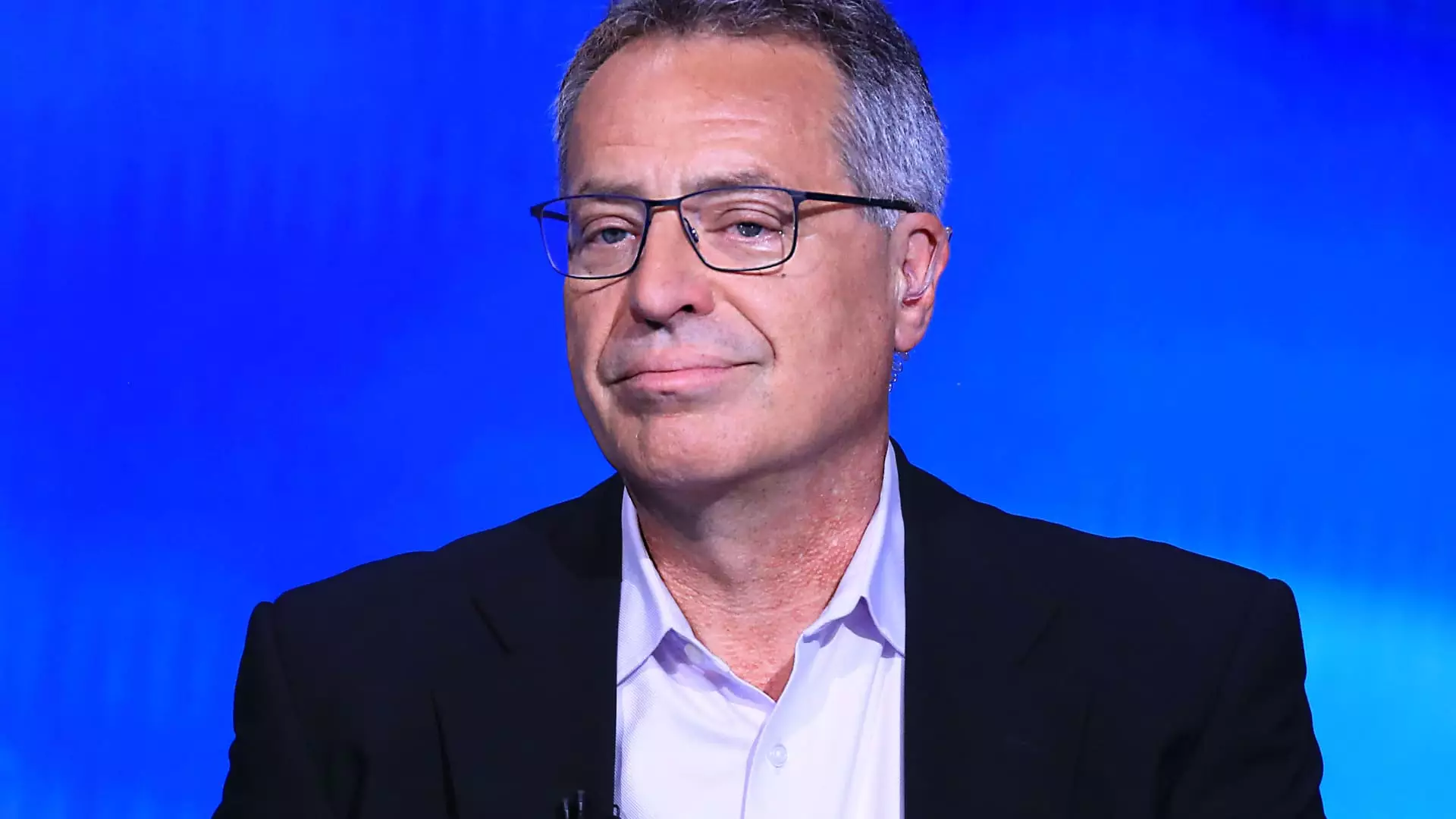

Nygren’s strategy involved a diligent assessment of Merck’s management, particularly under the leadership of CEO Rob Davis, whom he describes as exceptionally equipped to bridge the realms of finance and scientific inquiry. This dual understanding is critical for investors, as it suggests a leadership team that is not only knowledgeable but also proactive in addressing the company’s challenges. Nygren’s firm chose to wait for a market correction in summer, allowing them to purchase shares at a lower valuation when Merck’s stock experienced about an 8% decline in the third quarter. Such a tactical approach underscores the importance of timing and market sentiment in investment decisions.

One of the pillars of Nygren’s investment rationale lies in Merck’s robust drug portfolio, most notably its Keytruda franchise—an innovative cancer treatment that has the potential to further enhance Merck’s market standing. The prospects associated with possible extensions to this franchise may provide the catalyst necessary for share price recovery. By emphasizing the value of existing drug offerings, Nygren illustrates the inherent strengths that Merck possesses, despite recent setbacks.

Interestingly, Nygren is not exclusively fixated on pharmaceuticals but is also identifying value in unexpected sectors, particularly those integrating artificial intelligence with existing business processes. His mention of companies like Capital One and Charter Communications, which are leveraging AI technologies, reflects a broader view on technology’s role in fostering growth and efficiency within traditional industries. This diversification not only showcases Nygren’s astute market insight but also signals a transformative trend wherein companies traditionally uninvolved in tech may emerge as significant beneficiaries.

While Merck contends with immediate challenges, Bill Nygren’s endorsement signifies a wealth of potential for savvy investors willing to look beyond the temporary fluctuations. The mathematical backing of Merck’s drug portfolio, combined with strategic management insights and evolving market landscapes influenced by technology, solidifies its appeal in a diversified investment approach. As investors navigate these turbulent waters, Merck’s offerings may represent not just a counterbalance in a pro-cyclical portfolio but a robust growth opportunity for the discerning investor.