In recent trading sessions, the municipal bond market has exhibited a nuanced behavior, grappling with a slight softening while simultaneously demonstrating resilience against the prevailing weakness seen in the U.S. Treasury market. Over the last week, municipal bonds have outperformed Treasuries, a potential reflection of distinct investor preferences and market dynamics. The presence of several high-profile new issues brought significant attention and solid demand that reinforced the strength of these municipal securities.

The movement of triple-A municipal yield curves reflects a mixed yet stable position, with changes ranging from one to four basis points. This variability across different maturities highlights the complexities in investor perceptions related to risk and return, particularly when contrasting municipal bonds against Treasuries. The adjustments in the ratios of municipal to Treasury yields indicate a market that is recalibrating as external economic factors shift, with recent data from Refinitiv Municipal Market Data revealing alterations in ratios within various time frames.

For instance, the two-year municipal-to-Treasury ratio was reported at 63%, while the 30-year ratio stood at 84%. This downward adjustment in ratios can be interpreted as a reaction to a broader market context where investors are weighing risks associated with longer-term Treasuries against the relatively stable returns from municipal bonds.

A noteworthy driver behind the robust demand for municipal bonds appears to be the significant liquidity present in the market. With over $6 trillion held in money market funds and an additional $2.5 trillion in certificates of deposit, there is a considerable amount of capital seeking investment opportunities as interest rates gradually taper. Julio Bonilla, a fixed-income portfolio manager at Schroders, emphasized how this liquidity is crucial, suggesting that as rates begin to lower, investors may pivot from shorter instruments to longer-term bonds to lock in favorable terms.

Moreover, Bonilla pointed to the attractiveness of the municipal bond market, especially when evaluated on a tax-adjusted basis. This highlights a fundamental contrast with equity markets, where valuations may appear excessively high, thereby fostering a migration of capital into municipal securities.

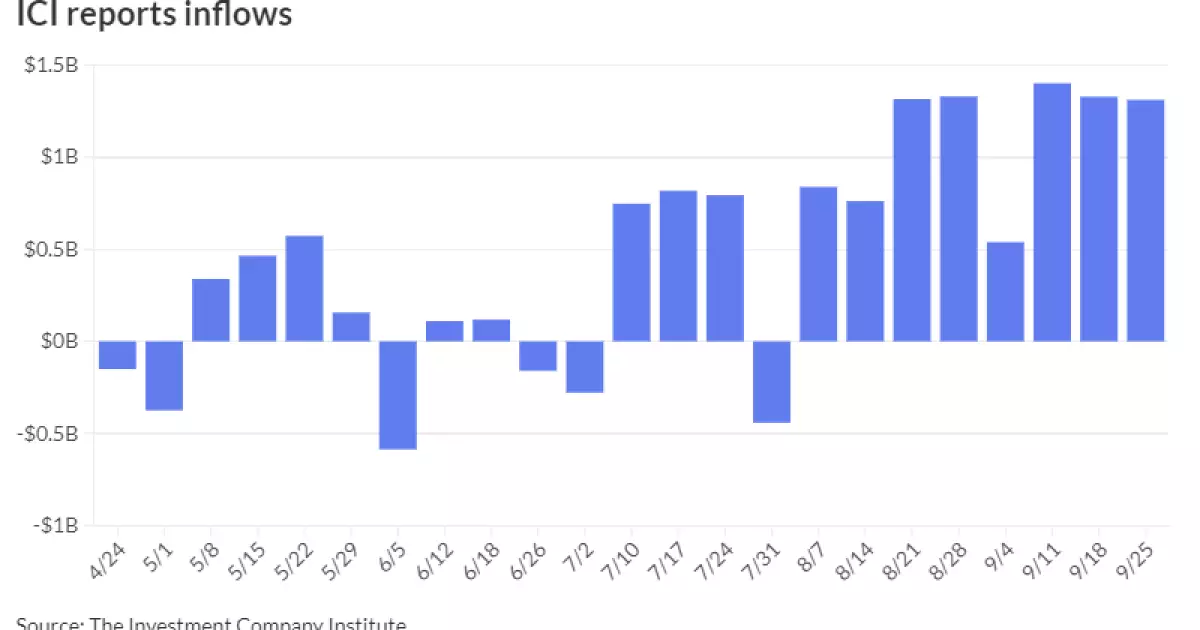

Investment Company Institute (ICI) data portrays a vibrant inflow trend into municipal bond mutual funds, with over $1.3 billion recorded in the week ending September 25. This flow into ETFs, alongside continually elevated trading volumes in separately managed accounts, underscores a growing investor appetite for municipal securities amid a fluctuating economic backdrop. Despite a decrease in the number of individual trades, the heightened overall volume indicates greater reliance on institutional buying, thus augmenting the significance of these funds in shaping market performance.

Analysts like Matt Fabian from Municipal Market Analytics have noted that this heightened inflow and trading activity is pivotal, particularly as banks exhibit increasingly flat demand. The potential for a rise in the municipal market performance looms, especially if refunding activities surge toward the year-end, which could push annual issuance levels to historical highs.

In the primary market, notable transactions have encapsulated the active spirit within municipal financing. For instance, Columbia University’s recent $500 million offering included both taxable and revenue bonds and arrived at competitive spreads. Transactions such as these illustrate investor confidence and the well-established demand for high-quality municipal bonds.

Moreover, several significant transactions from entities such as the Kentucky State Property and Buildings Commission and Massachusetts’ Commission Transportation Fund showcased robust pricing trends despite the broader context of U.S. Treasury weaknesses. This aligns with investor sentiment favoring the stability associated with municipal issuances, particularly as bond prices align closely with investor risk tolerance and return expectations.

The current landscape of the municipal bond market exemplifies a sector capable of absorbing external shocks while catering to persistent investor demand. As liquidity remains abundant and tax-adjusted returns remain appealing, the municipal bond space seems well-positioned to navigate the challenges presented by a shifting Treasury market. Furthermore, with continued inflows and supportive economic indicators, municipal bonds are not merely a refuge but a potential driver of capital stability in an increasingly unpredictable financial environment. As we move further into the fiscal year, the outlook for the municipal market remains robust, underscoring its importance in the broader realm of fixed-income investments.