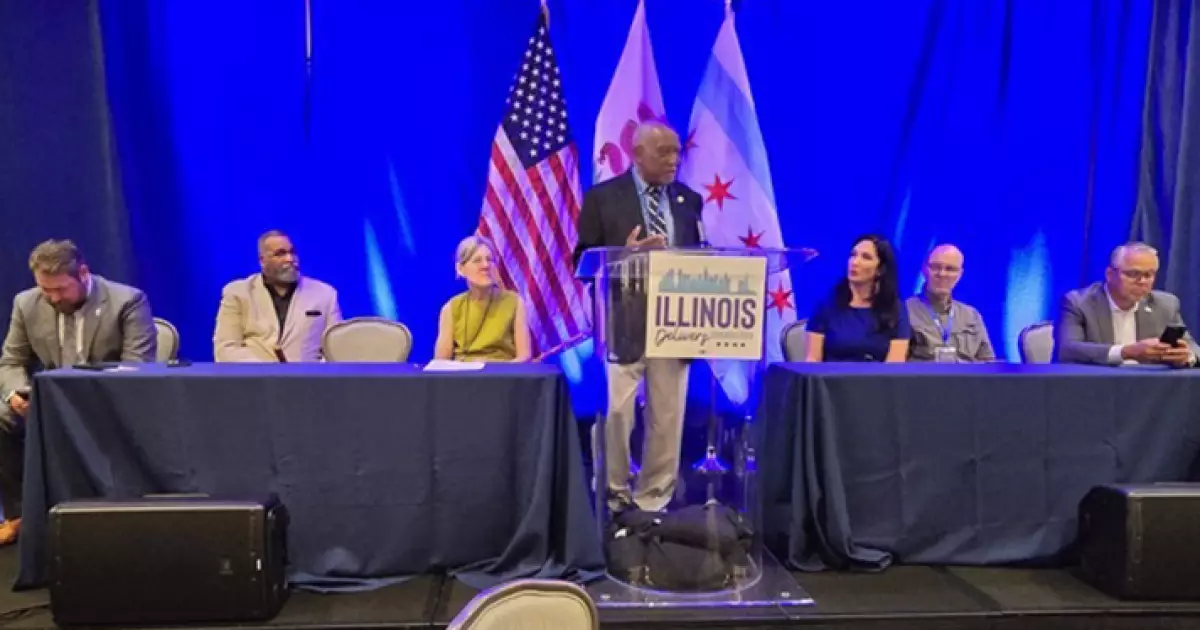

Advocates for a national infrastructure bank have been hard at work, trying to gain support for a bill introduced by Rep. Danny Davis, D-Ill., that would establish one. During the Democratic National Convention, members of the National Infrastructure Bank Coalition made their case to delegates and other political figures. They emphasized the importance of a national bank that would provide low-cost loans for state and local infrastructure projects. Despite the focus on other political matters during the convention, the supporters managed to generate interest and curiosity about the concept of a national infrastructure bank.

With the Infrastructure Investment and Jobs Act set to expire in 2026, there is a growing concern about how to address the nation’s infrastructure challenges. The supporters argue that a national bank, capitalized with existing Treasury debt, is essential to address the country’s infrastructure needs. They point out that it can be difficult to pass expensive infrastructure bills in Congress, regardless of the political climate. Therefore, having a mechanism like a national infrastructure bank, similar to those used in other countries, is seen as a viable solution to the problem.

Rep. Danny Davis’s bill, the National Infrastructure Bank Act of 2023, proposes the establishment of a $5 trillion national bank. This bank would provide loans to public entities for various infrastructure projects, including state and local governments, utilities, and public-private partnerships. The capitalization of the bank would involve issuing stock to holders of Treasury securities and municipal bonds. Additionally, the bank would have access to a discount line of credit with the Federal Reserve System. The proposed bank would focus on financing projects in 20 different infrastructure categories, ranging from lead pipe replacement to a national high-speed rail system.

Support and Opposition

The bill has garnered support from 37 co-sponsors, all Democrats, as well as numerous state legislatures and city councils. Even groups like the National Association of Counties have expressed their support for the idea of a national infrastructure bank. However, not everyone is on board with the proposal. Some municipal market groups, such as the Bond Dealers of America and the American Securities Association, have opposed the bank. They believe that the traditional role of the municipal market in infrastructure financing is sufficient and that efforts should instead focus on other financing tools.

Historical Context

The concept of a national infrastructure bank is not new, with President Obama proposing one in 2008 and 2010. More recently, the IIJA would have included a provision for a bank, but it was ultimately removed. Despite the long history of discussions about a national infrastructure bank, the supporters remain hopeful that the bill will gain traction in the future. While the bill may not pass this year, advocates are working to reintroduce it in the next session with the existing support already in place.

The establishment of a national infrastructure bank has the potential to address the nation’s pressing infrastructure needs. While there is growing momentum and support for the idea, there are still opposing viewpoints that need to be addressed. It remains to be seen whether Rep. Danny Davis’s bill will ultimately become a reality, but the discussion around a national infrastructure bank is likely to continue in the coming years.