The municipal bond market has seen little change on Thursday, with U.S. Treasury yields increasing and equities closing lower. According to AllianceBernstein strategists, the technical picture this summer has been stronger in 2024 compared to the situation in 2023. Last year, the total returns for June through August were negative, with August wiping out the gains from June and July as UST yields surged and muni yields followed suit. Specifically, the 10-year muni yield rose by 36 basis points during August 2023.

On the contrary, this year’s performance in the municipal bond market has been quite remarkable. Munis have returned 3.11% from June through August 16, which is a stronger showing than in 2023, even with the increase in issuance. Issuers have been frontloading ahead of November to avoid market volatility related to the election. While issuance slowed on Thursday following a busy primary earlier in the week, there were still a few large deals coming to market. The market has been able to digest the influx of issuance quite well, as highlighted by Catherine Stienstra, head of municipal bond investments at Columbia Threadneedle Investments.

Despite the high level of supply, the muni market remains “constructive” due to the appealing yields that are available. Stienstra noted that although yields were relatively stable on Thursday, they are still higher than they have been in the past, presenting a compelling opportunity for high-net-worth individuals to capture these elevated yields. As a result, separately managed account (SMA) growth is expected to continue as long as yields remain at these levels. SMAs have been absorbing a significant portion of the supply within 15 years, as evidenced by the rich muni-UST ratios.

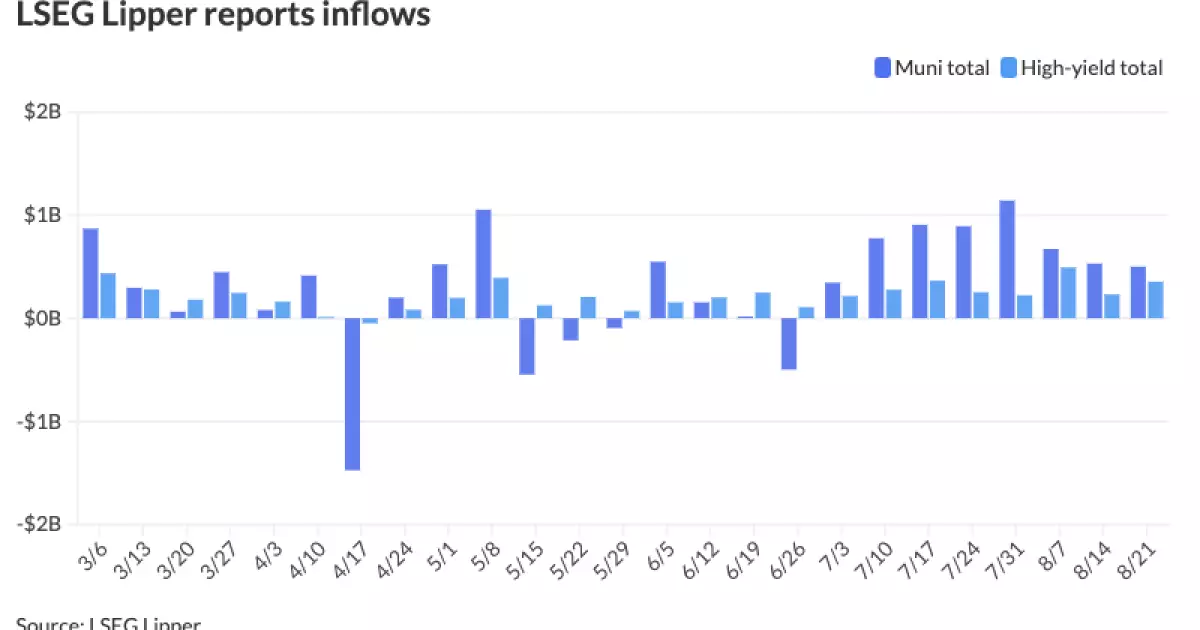

There has been a recent trend of inflows into muni mutual funds, albeit at a slower pace than anticipated following significant outflows in 2022 and 2023. Data from LSEG Lipper shows that municipal bond mutual funds received inflows of $500.4 million after $530.3 million of inflows in the previous week. This marks the eighth consecutive week of inflows. Inflows into high-yield funds also remained strong, with $354.8 million flowing in after $231 million in the prior week. Anticipation of a Fed rate cut has played a role in boosting investor confidence, as the volatility and duration concerns are expected to ease once the central bank takes action.

The recent Federal Open Market Committee (FOMC) minutes from the July meeting revealed that a rate cut was under consideration by several participants. The prevailing sentiment was that a cut could be implemented at the September meeting, given that many viewed the current policy as restrictive. Analysts like Abiel Reinhart of J.P. Morgan noted that the decision on whether to cut rates by 25 basis points or 50 basis points hinges on the upcoming employment report. While a rate cut is widely expected in September, there is still uncertainty surrounding the Fed’s messaging, as Chair Powell’s remarks at the upcoming Jackson Hole appearance could impact market expectations.

Recent Primary Market Activity

In the primary market, notable bond issuances included deals from various municipalities. Wells Fargo priced and repriced bonds for Dallas and Fort Worth, Texas, while BofA Securities handled bonds for the Los Angeles County Public Works Financing Authority. Wells Fargo also priced bonds for Charlotte, North Carolina. The various bond offerings highlighted the continued activity in the municipal bond market and the demand for fixed-income securities.

Throughout the day, various sources reported on the stability of yields in the municipal bond market. Refinitiv MMD, the ICE AAA curve, and S&P Global Market Intelligence all provided data on yield levels across different maturities. Bloomberg BVAL also reported on yield levels, demonstrating the overall stability in the market. Meanwhile, U.S. Treasuries showed firmer yields across various tenors, indicating a broader trend in the fixed-income market.

The municipal bond market continues to evolve, with changing dynamics influenced by economic indicators, market sentiment, and policy decisions. Investors and market participants are closely monitoring developments in the market, as they navigate through a landscape of shifting yields and evolving opportunities. Despite the challenges and uncertainties, the municipal bond market remains resilient, attracting investors seeking stable income and diversification in their portfolios.