Bitcoin price experienced a slight rise on Monday, recovering from recent losses following the halving event over the weekend. Despite the halving event, the launch of a new token minting protocol on the world’s biggest blockchain attracted more attention. This new protocol, known as Runes, allowed users to mint digital tokens on top of the Bitcoin blockchain, sparking a sevenfold increase in Bitcoin transaction fees.

The Runes protocol, introduced by Casey Rodarmor, distinguished itself from the previous ordinals protocol by enabling users to create new tokens, similar to those seen on the Ethereum blockchain. This launch led to a significant surge in Bitcoin transaction fees, hitting a record high of nearly $130 on April 20, before settling lower around $35 by Monday. The increase in transaction fees indicates potential revenue growth for Bitcoin miners, benefiting from the fee spike.

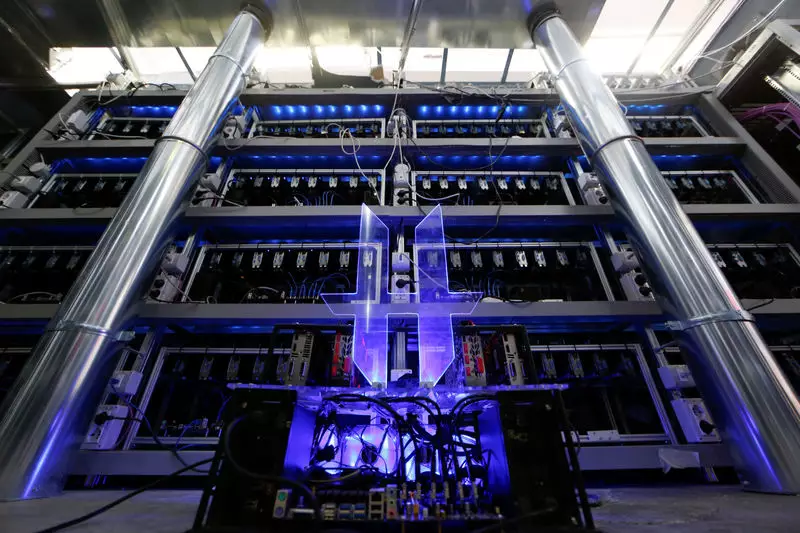

While the halving event had little immediate impact on Bitcoin prices, it is expected to pressure miners in the long run. However, mining stocks such as Marathon Digital Holdings Inc, Hut 8 Corp, Riot Platforms, and Core Scientific Inc could experience near-term gains due to the surge in transaction fees. The heightened activity in the blockchain space, driven by the Runes protocol, presents opportunities for miners to capitalize on increased revenues.

Despite the positive sentiment in the market, other major cryptocurrencies saw limited gains on Monday. Ethereum, the world’s second-largest token, rose by 1.1% to $3,208.95, while XRP and Solana recorded gains of 1.8% and 0.5%, respectively. The overall strength of the dollar and the expectation of higher U.S. interest rates restrained significant upside movements in crypto prices, including Bitcoin.

The introduction of the Runes protocol on the Bitcoin blockchain had a notable impact on transaction fees and market activity. While the halving event was overshadowed by this development, it is essential to monitor how the protocol’s implementation will influence Bitcoin price movements in the coming weeks. The increased on-chain activity offers insights into the evolving landscape of digital token creation and its implications for miners and investors alike.