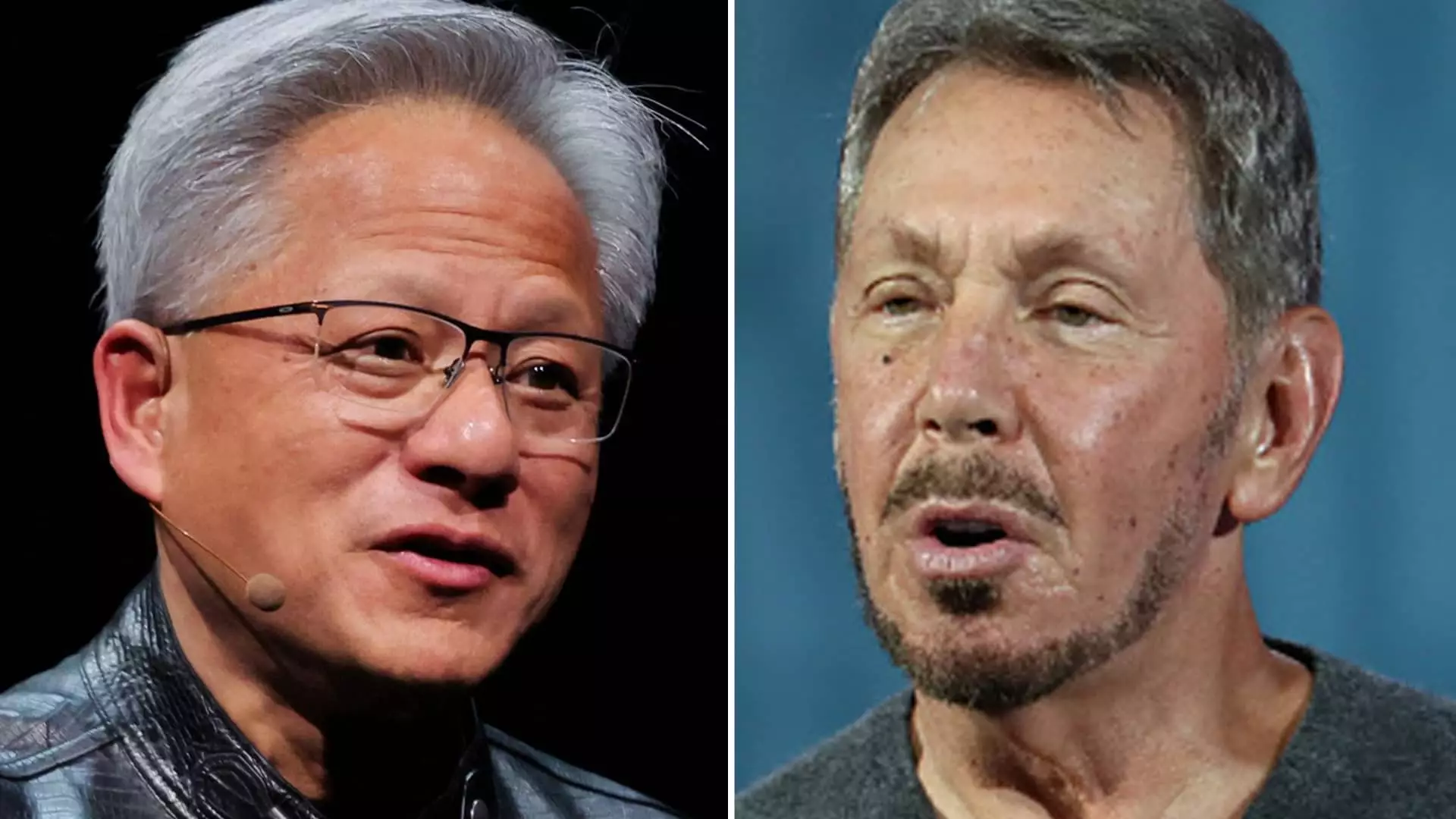

In the ever-volatile world of technology and finance, fortunes can shift remarkably quickly. As analysts project a dramatic rise in Larry Ellison’s wealth, there appears to be a potential upheaval in the rankings of the world’s richest individuals. Currently serving as the Chairman of Oracle Corporation, Ellison’s significant stock holdings in the company could catapult his net worth to an astonishing $206.5 billion within a year, according to a consensus derived from FactSet data. This would not only place him at the pinnacle of wealth but also surpass industry titans such as Jeff Bezos of Amazon, Elon Musk of Tesla, and Jensen Huang of Nvidia.

Oracle’s stock has experienced a remarkable surge, gaining nearly 60% in value this year alone, marking its best performance since 1999. This upward trajectory is largely a reflection of the broader tech market’s enthusiastic embrace of artificial intelligence (AI) technologies. Companies are scrambling to integrate AI into their offerings, and Oracle is capturing this momentum effectively. Following a robust fiscal first-quarter report, the company’s shares reached new heights, and for a brief moment, Ellison found himself entwined in a battle for the title of the world’s richest individual, currently dominated by Musk.

One investment strategist, Kim Forrest, captured the essence of Ellison’s leadership when she stated, “Larry has this uncanny ability to [spot] whatever’s hot at the moment.” This ability to identify and capitalize on trends has historically underpinned Oracle’s success. However, some skepticism remains regarding whether the direction of Oracle’s latest product line aligns with long-term future trends, highlighting Ellison’s tendency to pivot quickly in an ever-evolving tech landscape.

The rising fortunes of tech billionaires are not confined to Oracle alone. Since the launch of ChatGPT in late 2022, the entire tech industry has seen a surge in interest and investment in AI. Lower borrowing costs, courtesy of recent Federal Reserve rate cuts, may further catalyze this trend, providing firms with greater liquidity to fuel growth initiatives.

Amazon’s Jeff Bezos is projected to experience an uptick in his wealth as well, with analysts predicting a 16% growth in Amazon’s stock value. This rise could add approximately $27.8 billion to Bezos’ fortune, pushing his net worth to around $203.9 billion. Yet, this would still leave him trailing Ellison by a narrow margin, insinuating a tight race between the two billionaires.

Jensen Huang’s Nvidia has also been a frontrunner in capitalizing on the AI hype, boasting a staggering 135% increase in shares, following an astronomical 239% rise in 2023. Analysts suggest that Nvidia’s stock could surge even further, projecting a potential valuation increase to over $149 within the coming year. This forecast could translate to an additional $27.2 billion in wealth for Huang, bringing him closer to a total of $128.7 billion.

However, not all trajectories appear positive. Tesla’s Elon Musk could face a decrease in his wealth. Currently, his stake in Tesla is expected to see a downturn of nearly 11%, reducing his fortune from approximately $100.3 billion to around $89.6 billion, as the company encounters intensified competition and adjusts its pricing strategies in response to fluctuating demand for electric vehicles.

The technology sector not only defines the future of innovation but also dictates the financial standings of its key players. Larry Ellison stands on the cusp of potentially becoming the wealthiest individual in the world due to Oracle’s thriving market position, fueled by the booming AI sector. As the landscape evolves, it will be intriguing to see if Ellison can maintain his momentum against formidable competitors like Bezos, Musk, and Huang. The dynamics observed today hint at changes ahead, underscoring the unpredictable and often dramatic nature of wealth accumulation in the tech industry. As we glance toward a year filled with possibilities, one thing remains certain: the battle for the title of the richest person will continue to garner widespread attention and speculation.