In an era where public financing oftentimes falls short, governments are increasingly exploring alternative avenues for funding infrastructure projects. A significant step in this direction is the Innovative Finance and Asset Concession Grant program, launched under the 2021 Infrastructure Investment and Jobs Act. Providing nearly $50 million to 45 local, regional, and state public entities, this initiative stands as a testament to the burgeoning trend of public-private partnerships (P3s). As municipalities aim to catalog their assets for potential monetization, this program seeks to bridge the gap between public needs and private investment capabilities.

The U.S. Department of Transportation’s Build America Bureau administers the program, emphasizing its role in creating a comprehensive inventory of state and local assets. Allowing communities the opportunity to partner with private entities not only expedites project development but also promises additional public benefits such as affordable housing and urban infrastructure improvements. In a broader context, this approach may signal a significant shift in how public entities manage and view their assets. By utilizing federal funding to assist in asset evaluations, which can lead to productive collaborations, communities can potentially transform underutilized properties into revenue-generating ventures.

An important finding from the initial funding round is the emphasis on transit-oriented development (TOD), with over 70% of projects submitted reflecting this focus. TOD has gained traction as cities recognize the benefits of integrating transportation infrastructure with residential and commercial development. By receiving substantial funding, entities like Capital Metro in Austin and North Miami can initiate projects that align with regional growth strategies. These proposals are more than mere surface-level upgrades—they represent a strategic, holistic approach to urban planning, catering to residents’ needs, and incentivizing private investment.

While individual grant amounts hover around $1 million, this funding is structured to be impactful—providing essential resources for technical assistance and project development. There are two grant types: technical assistance grants that support the establishment of asset concessions and expert services grants that facilitate asset project development. This dual-faceted approach allows governments to tailor their requests based on specific needs, ensuring a more nuanced deployment of resources.

The Future of Public-Private Partnerships

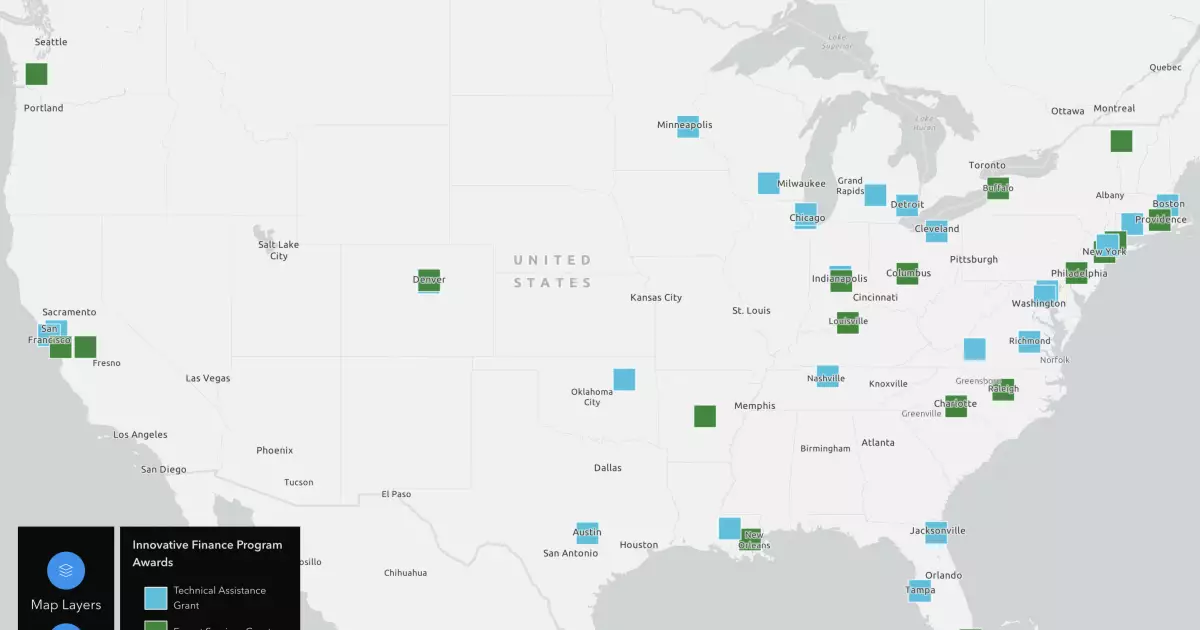

As the Biden administration aims to revitalize and modernize America’s infrastructure, programs like the Innovative Finance and Asset Concession Grant are crucial. They have the potential to revolutionize local economies by fostering essential partnerships between public entities and private investors. The interactive map detailing grant recipients facilitates transparency, encouraging other municipalities to pursue similar initiatives. Ultimately, the success of this program could encourage a deeper, more systemic embrace of P3s, setting a precedent for future infrastructure financing strategies across the nation.

While the Innovative Finance and Asset Concession Grant program is still in its infancy, the early results indicate a promising framework for ensuring sustainable urban growth and development through collaboration with the private sector. By leveraging federal funding strategically, local governments can usher in a new era of infrastructural efficiency and public benefit.