The Municipal bond market experienced a weaker performance on Thursday, influenced by the rise in U.S. Treasury yields and a rally in equities. This volatility has been particularly evident in the past several trading sessions, leading to fluctuations in both the municipal bond and UST markets. According to Jennifer Johnston, the director of research for municipal bonds at Franklin Templeton, the market has seen “crazy volatility” recently. Following a market rally earlier in the week, a subsequent selloff brought the market almost back to its starting point. Johnston noted that uncertainty surrounding the employment report, the upcoming Federal Open Market Committee meeting, and major political shifts have all contributed to market volatility in August. This uncertain political environment, with events like the assassination attempt on former President Donald Trump and the withdrawal of President Joe Biden from the race, has further added to the market’s instability.

The market’s volatility has had tangible effects on issuers, such as the city of Chicago, which pulled a planned $643.11 million deal of General Obligation Bonds that was set to price on Wednesday. Johnston suggested that more issuers may follow suit and postpone deals as they wait for the market to stabilize. With over five weeks until the Federal Reserve’s September meeting, issuance is expected to slow as the date approaches. However, Johnston mentioned that issuers are not likely to halt completely, raising questions about the demand for upcoming supply in the market.

Investor Behavior

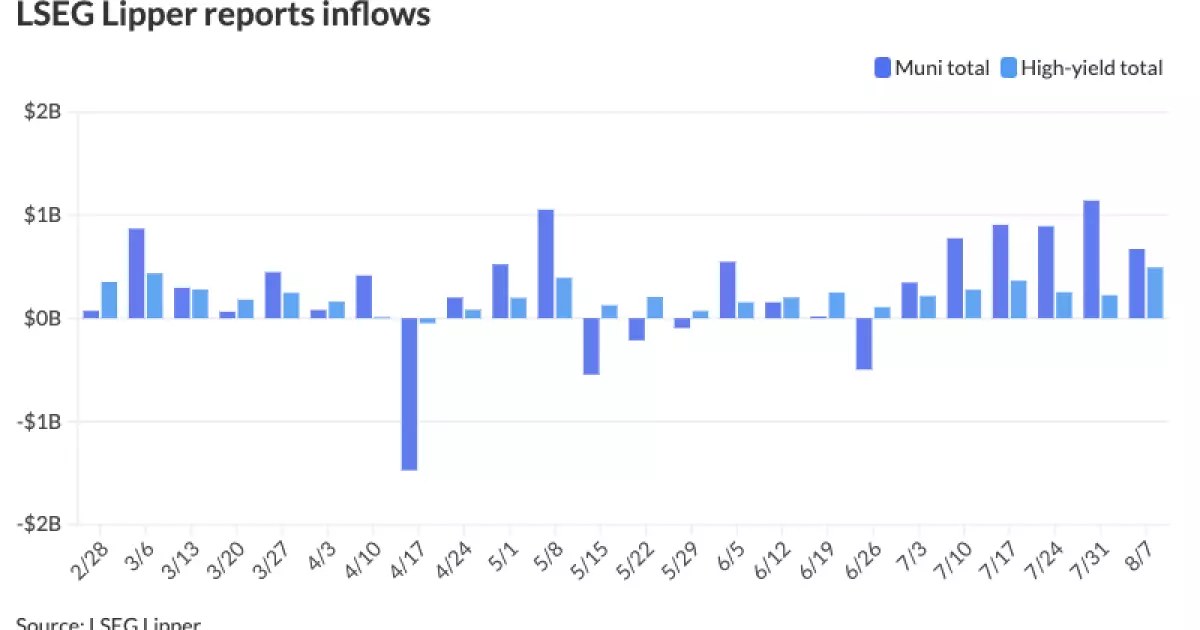

Despite the rise in yields, investors continue to find relative value in municipal bonds with maturities of 10 years and less. Muni to UST ratios have remained within a range, indicating a certain level of stability. Even as investors navigate market volatility, there has been consistent growth in separately managed accounts, while questions linger about when open-ended mutual funds will see a return of investment. The recent inflows into municipal bond mutual funds, totaling $671.5 million, have provided some optimism. High-yield bonds have also shown strength, with inflows of $492.5 million, reflecting positive market sentiment in certain segments.

In the primary market, several notable deals were priced on Thursday. J.P. Morgan priced $462.975 million of AMT Tampa International Airport revenue bonds, while Wells Fargo priced $167 million of Tamarron Project special revenue bonds for the National Finance Authority, New Hampshire. Frost Bank priced $141.755 million of PSF-insured unlimited tax school building bonds for the Pecos-Barstow-Toyah Independent School District, Texas. Goldman Sachs priced $105.82 million of Williams College issue revenue bonds for the Massachusetts Development Finance Agency. The competitive market saw Oyster Bay, New York, selling $135.24 million of bond anticipation notes to Wells Fargo.

The cut in AAA scales by Refinitiv MMD reflects the prevailing market conditions, with yields adjusting by three to six basis points. The ICE AAA yield curve and S&P Global Market Intelligence municipal curve also saw reductions by two to seven basis points and three to seven basis points respectively. Bloomberg BVAL recorded a cut of two to four basis points across different maturities. Treasuries were weaker, with varying yields, highlighting the interconnected nature of the bond and treasury markets.

The municipal bond market remains volatile, influenced by a variety of factors including political events and economic indicators. Investors and issuers alike must navigate this uncertainty, adapting their strategies to capitalize on opportunities while managing risks effectively. As market conditions evolve, proactive decision-making and a thorough understanding of the prevailing trends will be key to success in the municipal bond market.