In recent weeks, the municipal bond market has displayed resilience with a notable increase in mutual fund inflows and significant primary market activity. This article aims to dissect the latest movements within this sector, exploring the implications for investors and the broader economic landscape.

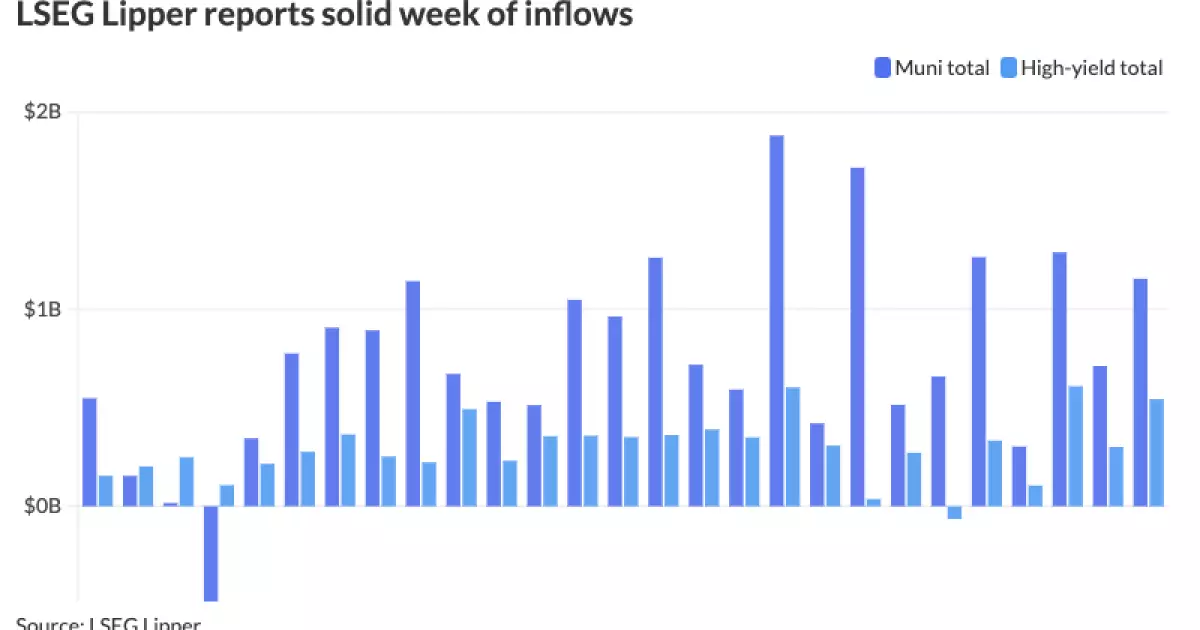

The municipal bond market witnessed minimal fluctuations in secondary trading, primarily due to a shift in investor attention towards primary market offerings. Significant inflows into municipal bond mutual funds, exceeding $1 billion for the week ending December 4, indicate a robust appetite among investors. This surge represented an increase from a revised figure of $711.5 million recorded in the previous week, suggesting that investor confidence remains strong, despite any underlying concerns within the broader economic framework.

High-yield municipal bond funds in particular experienced inflows of $534.1 million, a substantial rise from $300.6 million the week before. These trends imply that investors are actively seeking opportunities within the municipal bond market, possibly driven by the favorable yield environment that has characterized recent months. Chris Brigati, a senior vice president and director at SWBC, emphasized this sentiment by stating that the sustained inflows point to ongoing interest and robust demand from investors.

As municipal bonds gained attention, U.S. Treasuries presented a mixed performance, and equity markets closed in the red, further underscoring the shifting landscape. The two-year municipal to U.S. Treasury (UST) ratio was listed at 61%, with the five-year at 63% and the ten-year at 65%, according to Refinitiv Municipal Market Data. Such ratios are crucial as they guide investor decisions regarding comparative value between municipal securities and Treasuries.

Mixed signals from Treasuries could spur interest in municipals, especially considering the favorable ratios. The primary market continues to garner attention, as Brigati noted increasing demand, which could lead to a ramp-up in municipal issuances. With December historically being a strong month for bond sales, a potential uptick in issuance could align with rebalancing strategies to meet typical seasonal expectations.

The question of whether issuers will flood the market with bonds to capitalize on demand looms large among analysts. Recent political discourse surrounding tax exemptions has introduced uncertainty. Analysts like Matt Fabian of Municipal Market Analytics pointed out that past December issuances averaged around $31 billion, with variances from $21 billion to $56 billion. Given this year’s promising conditions, a total volume exceeding $500 billion seems plausible, particularly if municipal issuers respond strategically to current market risks.

Preserving the tax exemption for municipal bonds emerges as a crucial theme in this discourse. Daryl Clements and Matthew Norton of AllianceBernstein asserted that stripping away tax exemptions would severely hinder infrastructure investments across the nation. The bipartisan consensus on the necessity for improved infrastructure emphasizes the need for tax exemption retention, as its elimination could only marginally benefit federal revenues while upending local economic stability.

The primary market has been bustling with substantial deals. Notably, Barclays priced $1.5 billion for the New Jersey Transportation Trust Fund Authority, with attractive rates for various maturities, ranging from 2.90% to 4.21%. Similarly, J.P. Morgan Securities made headlines with the pricing of $772.65 million in airport facilities revenue bonds for the Greater Orlando Aviation Authority, showcasing continued investor interest in essential services financing.

Other noteworthy issuances included $653.63 million from the Sales Tax Securitization Corporation in Illinois and $480 million from the Alabama Industrial Development Authority. Each of these deals reinforces the notion that investors are keen on tapping into municipal offerings, attracted by the unique attributes these bonds provide—tax-exempt income and relatively stable returns.

As December unfolds, the municipal bond market remains at a critical juncture. Factors such as mutual fund inflows, primary market activity, and tax legislation considerations will shape the future landscape. The ongoing demand and significant inflows suggest that investors have not lost faith in municipal bonds, seeing them as essential components of a balanced portfolio. Monitoring these trends will be vital for understanding the evolving dynamics and opportunities that this sector presents.

While challenges remain—both political and market-driven—the resilient interest from investors underscores the continued attractiveness of municipal bonds as a sound investment choice in a fluctuating economic environment.